A platform for creating and managing tokenized basket funds.

Bond Details

- Discount Rate: 20% to 10%

- Vesting Duration: 10 days to 5 days

- Start-End Time:

- Refund Policy: Refundable within the vesting period (If not any claim made)

- Staking Requirement: According to the new Tier System

Table of Contents

- Introducing Alvara Protocol

- Features & Products

- Roadmap

- Revenue Streams

- Tokenomics & Token Utilities

- Disclaimer

Introducing Alvara Protocol

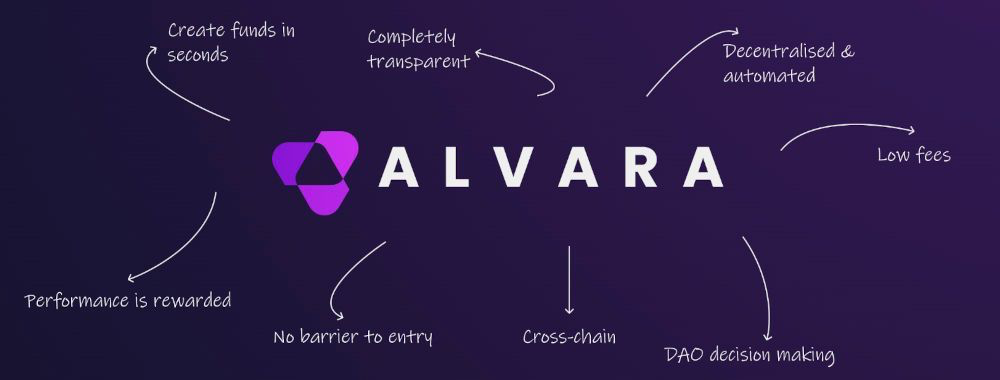

Alvara Protocol is a pioneering platform that revolutionizes the creation and management of decentralized, tokenized investment funds. Leveraging the innovative ERC-7621 "Basket Token Standard" (BTS), Alvara allows users to mint and manage their unique BTS tokens, effectively tokenizing diversified investment portfolios on the blockchain. The protocol operates on the Ethereum blockchain but is designed to be fully chain-agnostic, enabling cross-chain fund creation and management.

Alvara addresses key challenges in traditional finance and cryptocurrency investment by lowering entry barriers for fund managers, ensuring on-chain transparency, and managing market volatility through diversified funds. Additionally, it simplifies investment decisions with a network of verifiable fund managers and promotes wider adoption of decentralized finance by bridging it with traditional markets.

Features & Products

-

BTS Factory: This is the primary infrastructure for designing and minting BTS tokens. Users can create their own tokenized investment funds by selecting and weighting various assets, including a mandatory minimum of 5% ALVA tokens. The BTS Factory simplifies the process, making it accessible even to users with minimal technical expertise.

-

The Leaderboard: Alvara's leaderboard ranks all BTS tokens based on performance metrics, offering transparency and fostering competition among fund managers. This feature helps investors make informed decisions by providing detailed performance histories of each fund.

-

The Alvara DAO: Governed by the veALVA governance token, the Alvara DAO allows ALVA token holders to participate in decision-making processes, including protocol upgrades and fund management strategies. The DAO structure ensures that the protocol evolves based on the community's collective wisdom and interests.

-

The HiveX: Alvara's decentralized exchange (DEX), HiveX, facilitates trading of BTS LP tokens. It provides liquidity, passive earnings, and arbitrage opportunities, benefiting both fund managers and liquidity providers through shared trading fees.

-

The BTS Marketplace: This marketplace enables the buying and selling of BTS tokens, allowing fund creators to auction their tokens and transfer management rights. Detailed information about each BTS, including performance metrics and underlying assets, is provided to help buyers make informed decisions.

Roadmap

-

Q1 2024: Launch of the Alvara Protocol and ALVA token on the Ethereum blockchain. Initial deployment of the BTS Factory and the HiveX decentralized exchange.

-

Q2 2024: Integration of cross-chain capabilities, enabling BTS creation on BNB Chain, Fantom, and Avalanche C-Chain. Introduction of the advanced leaderboard for fund managers.

-

Q3 2024: Deployment of the Alvara DAO for decentralized governance. Launch of the BTS Marketplace for trading BTS tokens. Initial security audits and penetration testing by Quill.

-

Q4 2024: Release of the proprietary backtesting and analysis tool for BTS managers. Implementation of yield generation strategies via DeFi protocols such as Aave and Compound.

-

Q1 2025: Expansion of BTS Factory to support a wider range of tokenized assets, including real estate and commodities. Further enhancements to the HiveX and the introduction of advanced liquidity provision mechanisms.

-

Q2 2025: Rollout of additional staking and governance features, including veALVA token utilities. Continuous platform improvements based on community feedback and governance proposals.

-

Q3 2025: Introduction of educational materials and resources for BTS managers. Enhanced gamification features to promote competition and transparency among fund managers.

-

Q4 2025: Expansion of the Alvara ecosystem to include new strategic partnerships and integrations with other blockchain projects and financial institutions. Continuous updates and improvements based on market trends and user feedback.

Revenue Streams

-

Platform Fees: Alvara generates revenue through various platform fees associated with its services. These include:

-

BTS Factory Deployment: A 1% fee for deploying a new BTS, distributed as 0.85% to the Alvara Foundation, 0.1% to ALVA stakers, and 0.05% burned.

-

Contribution Fees: A 0.5% fee on contributions to BTS, allocated similarly as deployment fees.

-

Redemption Fees: A 0.5% fee on BTS redemptions, following the same distribution as contribution fees.

-

Management Fees: Annual management fee of 1% of AUM for each BTS, entirely allocated to the BTS manager.

-

HiveX Transaction Fees: A 0.3% transaction fee on the HiveX exchange, distributed among the Alvara Foundation, BTS managers, ALVA stakers, HiveX LP holders, and for burning.

-

-

Staking Rewards Vault: A percentage of platform fees are allocated to the Staking Rewards Vault, offering rewards to users who stake their ALVA tokens.

-

Yield Generation: BTS managers can utilize DeFi lending protocols to generate additional yield from underlying assets, which can be reinvested into the funds or distributed to BTS LP holders as dividends.

-

Marketplace Transactions: Revenue from listing and trading BTS tokens on the BTS Marketplace, where creators can auction their tokens and transfer management rights.

Tokenomics & Token Utilities

-

Token Ticker: $ALVA

-

Network: Avalanche & Ethereum

-

Total Supply: 200,000,000

Alvara's Token Utilities include:

-

Access to Voting Power: Users must stake their ALVA tokens to obtain veALVA, which is used for voting on proposals within the Alvara DAO. veALVA is also used during the weekly gauge weight voting to allocate ALVA rewards to nominated BTS funds.

-

**Access to Staking Rewards:**Staking ALVA tokens on the platform grants users access to the Staking Rewards Vault, which is funded by a percentage of platform fees.

-

Inclusion in Every BTS: Each BTS minted on the platform includes a minimum 5% weighting of ALVA tokens.

Disclaimer

Before you consider participating in any investment opportunities on Finceptor, please take a moment to read and understand the following important information. Investing in cryptocurrencies, Web3 projects, and participating in token sales involve inherent risks you should be aware of.

Risk of Loss: Investing in cryptocurrencies and Web3 projects carries a significant risk of financial loss. Prices of tokens and cryptocurrencies can be extremely volatile and unpredictable. You could lose all or a substantial portion of your investment.

Research: You are responsible for conducting thorough research before participating in any investment opportunity. This includes understanding the project's purpose, technology, team, and market potential. Do not invest solely based on hype or promises.

Regulatory Considerations: Cryptocurrencies and Web3 projects are subject to various regulatory frameworks in different jurisdictions. Regulatory changes could impact the legality and functioning of projects. Ensure you understand the legal implications in your country or region.

Scams and Fraud: The cryptocurrency space has been associated with scams, fraudulent schemes, and phishing attacks. Be cautious of unsolicited offers, and always verify the authenticity of the information and individuals involved in a project.

Unpredictable Technology: Web3 projects use new and advanced tech that might not be fully checked. This could lead to problems and money loss.

Liquidity Risks: Tokens acquired through pre-sales or investments may not have an active secondary market initially, which could limit your ability to buy, sell, or trade them.

Financial Advice: The information provided on our platform, including whitepapers, project details, and investment recommendations, should not be considered financial advice. You should consult with a qualified financial advisor before making any investment decisions.

You acknowledge and accept these risks by accessing and using Finceptor's investment platform. You agree to conduct due diligence and make investment decisions based on your own judgment. Finceptor does not assume any responsibility for your investment choices or the outcomes thereof.

Please remember that investing in cryptocurrencies and Web3 projects can be speculative and involves high risk. Only invest what you can afford to lose.

This disclaimer is designed to inform potential investors about the risks and considerations associated with participating in the Finceptor investment platform. However, it is advised to consult legal experts to ensure the disclaimer is appropriate for your specific circumstances and legal requirements.

Purchasing, holding, and transacting in any way with tokens shall not warrant, commit nor guarantee any revenue, profit, or value appreciation. Purchasing tokens shall not be construed as an investment. Token merely offers utilities and features within the project's ecosystem and platforms. Finceptor reserves its right to amend and modify the utilities and features offered by the project.

Crypto and crypto assets transactions, including tokens, are very risky regarding potential losses, merchantability, technical failures, and legal and tax requirements. Indeed, the price of crypto assets can even become zero or be excessively volatile. By purchasing and holding or transacting in any way with the token, you agree and acknowledge that you undertake such risks on your own and shall consult your legal and tax consultants for compliance purposes.

We do not provide investment or financial advice, and all projects reviewed are done objectively in accordance with established reporting and information dissemination best practices. Before investing in any Web3-related project, you should conduct your research. As a result, Finceptor is not liable for any losses incurred due to a consumer's investment decision.