Ink Finance is a financial infra for protocols, DAOs, and RWA Originators.

Bond Details

- Discount Rate: 20% to 10%

- Vesting Duration: 10 days to 5 days

- Start-End Time:

- Refund Policy: Refundable within the sale period (24 Dec, 1 pm UTC) if no claims made.

- Staking Requirement: According to the new Tier System

Table of Contents

- Introducing Ink Finance

- Highlights

- Features & Products

- Roadmap

- Revenue Streams

- Tokenomics & Token Utilities

- Marketing & User Acquisition Strategy

- Team

- Investors & Partnerships

- Disclaimer

Introducing Ink Finance

Ink Finance is a comprehensive DeFi infrastructure platform revolutionizing financial governance for DAOs and Web3 organizations. Designed with scalability, interoperability, and compliance at its core, Ink Finance equips decentralized entities with cutting-edge tools to manage, deploy, and optimize financial resources efficiently. By bridging the gap between Web2 and Web3, it enables organizations to seamlessly adopt compliant, on-chain structures while maintaining advanced risk management and operational transparency.

Successfully deployed on leading blockchain networks like Avalanche, Polygon, Arbitrum, BNB Smart Chain, and Bitlayer, Ink Finance powers over 390 DAOs and serves more than 196,000 users, generating over $750,000 in fees as of Q3 2024. With its modular infrastructure, credit-based DeFi capabilities, and the innovative InkEnvelope Asset Abstraction Layer, Ink Finance provides unmatched flexibility, making it an essential backbone for collaborative financial operations across DeFi and traditional finance sectors.

Highlights

-

Since launching its dApp in the second quarter of 2024, Ink Finance has generated over $750,000 in fee revenue!

-

390+ DAOs, and over 120k+ users already onboarded!

-

Backed by high-profile investors such as: Republic, ALLIANCE (Incubator of PumpFun), Blizzard (Avalanche Ecosystem Fund) and many more!

-

Top Tier Exchanges, Partnerships & Integrations!

Features & Products

-

Modular Infrastructure: Customize financial operations with flexible, rule-based governance.

-

Credit-Based DeFi: Establish on-chain reputation and creditworthiness for users and organizations.

-

Unified Custodian Vault (UCV): Enhance asset security with multi-layered custodian control.

-

InkEnvelope: Unify asset description and settlement across chains and real-world assets.

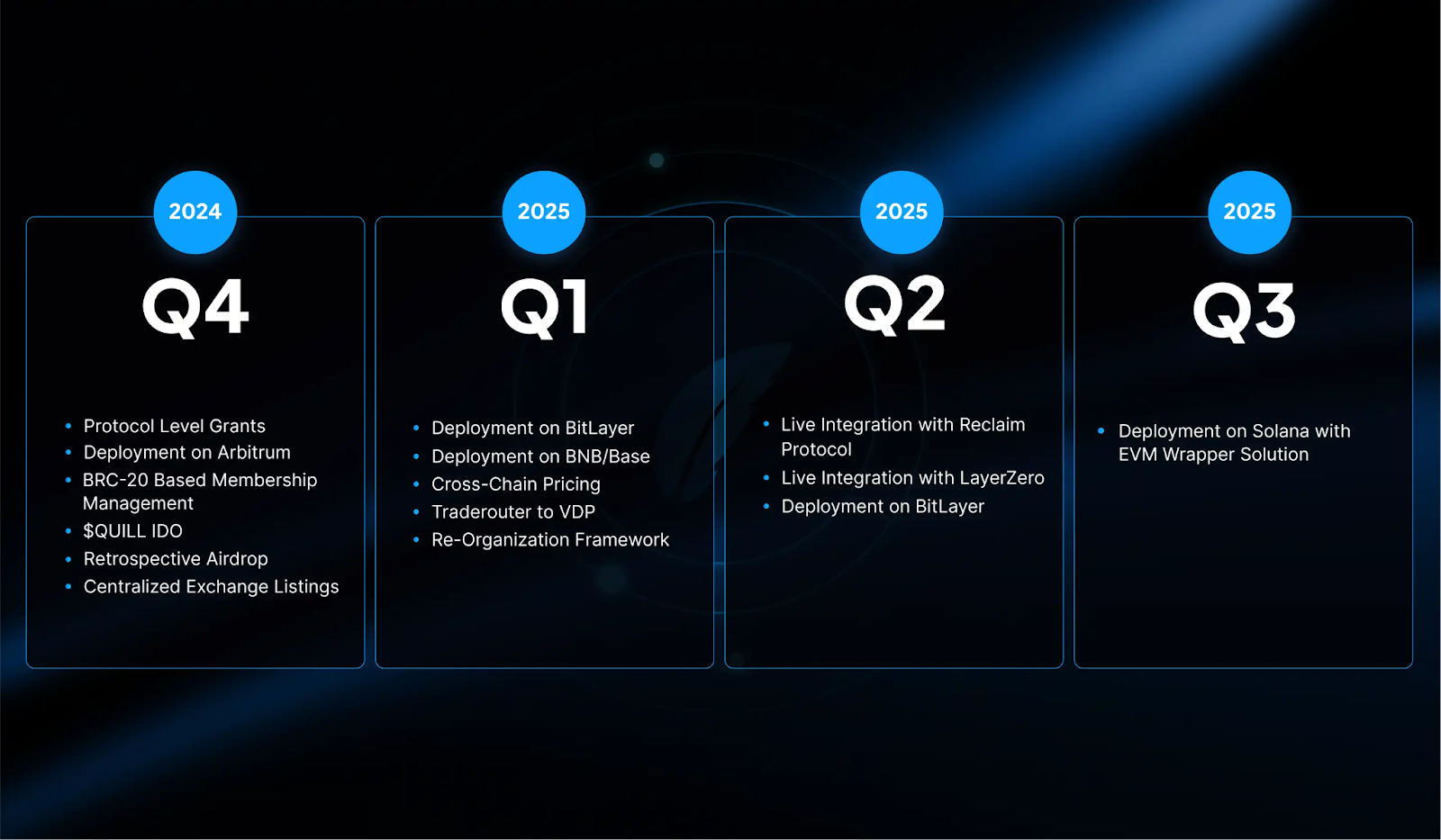

Roadmap

Revenue Streams

-

Based on the “Stake-to-use” (QUILL as a turn-key equipment) Utility: The QUILL tokens can be acquired and staked as the turn-key capital by any DAO/org/institution/ecosystem who uses the protocol. The Ink Finance protocol can sell the token reserve to these user groups to receive proceeds at market values.

-

Based on the “Rent-to-use” (QUILL as a lease equipment) Utility: Any QUILL holders can pool their tokens under INK’s sub incubation sub DAO to cross-chain sponsor any ecosystem that cannot or will not buy and stake QUILL. These pooled QUILLs will earn bespoke rental income, turning QUILL into a leasable working capital - an innovation of the DeFi sector.

-

Note: during the bootstrapping stage, 13% of the total issued QUILL will form the Ecosystem Fund that’s dedicated to generating rental income. INK.HK is set up as a commercial arm to lease this asset to trade-fi, web2, and other e-commerce corps, and INK.HK pays the INK MAIN DAO Treasury a carry.

-

Leasing of this asset to activate SaaS usage will accrue revenue via a subscription based model.

-

Transaction Fees: The INK MAIN DAO manages an Incubation Sub DAO that pools publicly held QUILLs to lend to any user group who cannot buy and stake $QUILL tokens. While 80% of such rental income goes to the pooling public, Ink Finance protocol charges management fees on the treasury and fundraising usage, and such fees will accrue to the INK MAIN DAO’s treasury.

Tokenomics & Token Utilities

-

Token Ticker: $QUILL

-

Token Standard: ERC-20

-

Network: Avalanche (C-Chain)

-

Total Supply: 100,000,000

-

Fully Diluted Valuation: $60,000,000

-

Initial Market Cap Without Liquidity: $890,000

-

Initial Market Cap: $2,000,000

Finceptor’s investors will participate in the Public Round and will have 20% of their tokens available at launch.

The Ink Finance $QUILL Token Facilitates Multiple Use Cases, Serving as a Governance Instrument and a Multi-Utility Vehicle:

-

Governance Capital

-

Supplying

-

Staking

-

Yield Generation Utility

-

Staking Emissions

-

Public Incubation Capital

-

Lending

-

SaaS Utility

Marketing & User Acquisition Strategy

Ink Finance is not just another DeFi protocol; it represents the foundational infrastructure set to redefine how decentralized finance interacts with real-world governance and compliance. The marketing strategy reflects this transformative ambition, focusing on credibility, sustainable growth, and long-term impact. Before the IDO, Ink Finance emphasizes building trust and establishing strategic partnerships. This involves collaborating with key opinion leaders (KOLs) who are deeply integrated into both Web3 and traditional finance ecosystems, securing high-profile alliances with institutional investors and DeFi leaders to position the platform as a critical player in the financial landscape, and executing educational campaigns. These campaigns include incentivized testnet and mainnet activities, AMA sessions, and detailed white papers to educate early adopters about the advanced governance capabilities Ink Finance offers to DAOs and decentralized financial entities. Post-IDO, the strategy shifts toward sustainable growth and adoption by high-value users. Ink Finance aims to onboard real-world use cases, including regulated industries such as loan syndicates, cross-border payments, and supply chain financing, effectively bridging traditional finance and DeFi. The platform prioritizes product-driven growth by delivering user-centric features such as compliance tools, multi-chain operations, and governance tokenomics, ensuring its indispensability for DAO governance. Community-focused initiatives, such as governance token staking, liquidity mining, and rewards for decentralized decision-making, are designed to transform early adopters into advocates, driving broader adoption by institutional users and DAOs. User acquisition efforts include targeted pilot programs with established DAOs to demonstrate how Ink Finance optimizes governance models and scales operations. Additionally, the platform pursues B2B marketing and compliance-driven partnerships to attract financial entities seeking to decentralize their governance, ensuring steady user growth and the inclusion of real-world capital in DeFi. Ink Finance’s hybrid approach—integrating advanced technology with institutional-grade partnerships—ensures long-term impact, rapid user adoption, and increased market visibility.

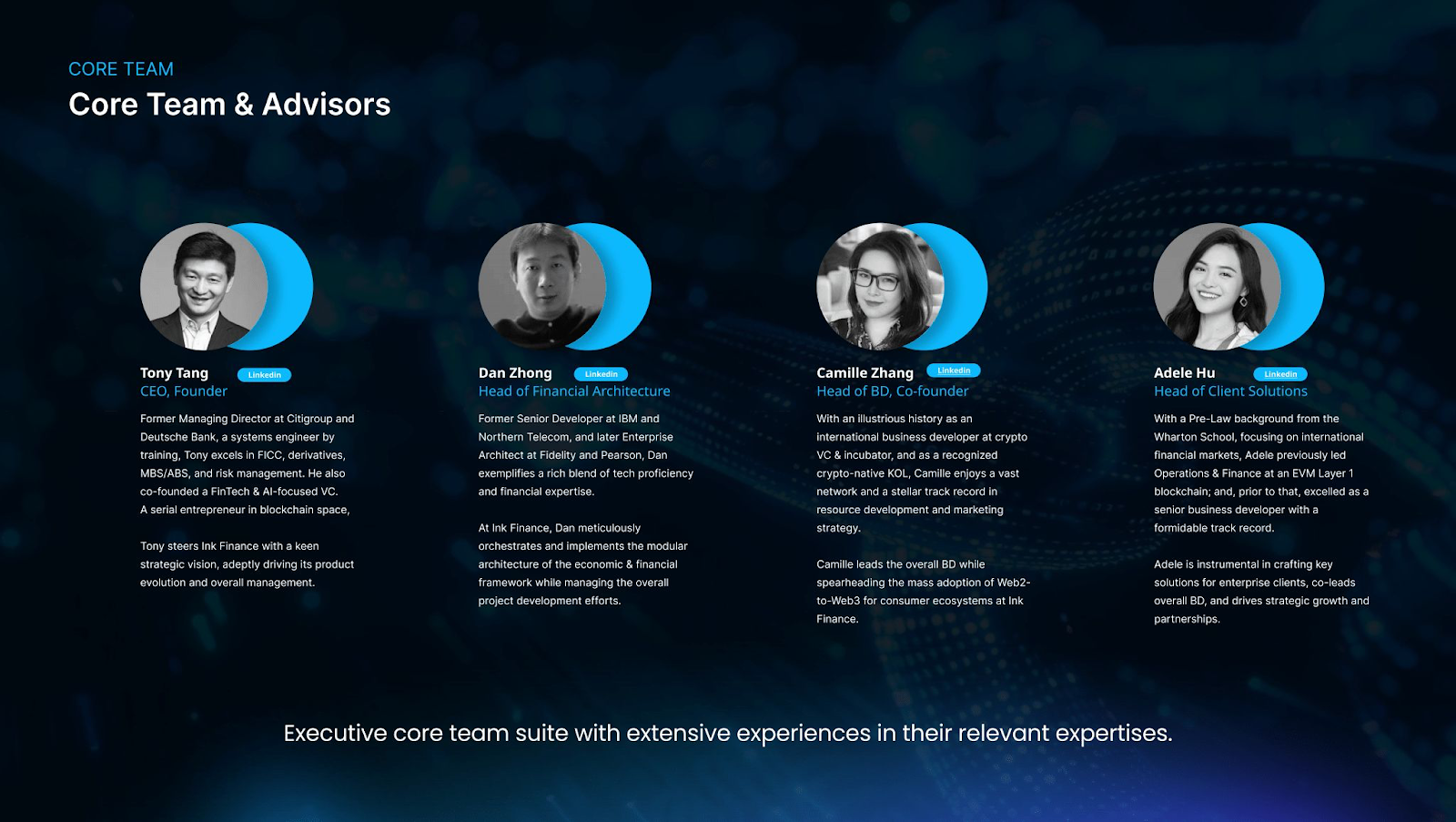

Team

-

Tony Tang - CEO & Founder: Former Managing Director at Citigroup and Deutsche Bank with expertise in FICC, derivatives, and risk management. A systems engineer and serial entrepreneur in the blockchain space, Tony also co-founded a FinTech and AI-focused VC. He leads Ink Finance with strategic vision, overseeing product evolution and management.

-

Dan Zhong - Head of Financial Architecture: Former Enterprise Architect at Fidelity and Pearson, with a background as a Senior Developer at IBM and Northern Telecom. Dan combines technical and financial expertise to design and implement Ink Finance’s modular economic and financial architecture while managing project development.

-

Camille Zhang - Head of BD, Co-founder: A crypto-native KOL and international business developer with experience at a crypto VC and incubator. Camille leverages her extensive network to lead Ink Finance’s business development, focusing on Web2-to-Web3 adoption for consumer ecosystems.

-

Adele Hu - Head of Client Solutions: A Wharton Pre-Law graduate specializing in international financial markets. Formerly led Operations & Finance at an EVM Layer 1 blockchain and has a strong track record in business development. Adele drives client solutions, co-leads business development, and fosters strategic partnerships and growth.

Investors & Partnerships

Disclaimer

Before you consider participating in any investment opportunities on Finceptor, please take a moment to read and understand the following important information. Investing in cryptocurrencies, Web3 projects, and participating in token sales involve inherent risks you should be aware of.

Risk of Loss: Investing in cryptocurrencies and Web3 projects carries a significant risk of financial loss. Prices of tokens and cryptocurrencies can be extremely volatile and unpredictable. You could lose all or a substantial portion of your investment.

Research: You are responsible for conducting thorough research before participating in any investment opportunity. This includes understanding the project's purpose, technology, team, and market potential. Do not invest solely based on hype or promises.

Regulatory Considerations: Cryptocurrencies and Web3 projects are subject to various regulatory frameworks in different jurisdictions. Regulatory changes could impact the legality and functioning of projects. Ensure you understand the legal implications in your country or region.

Scams and Fraud: The cryptocurrency space has been associated with scams, fraudulent schemes, and phishing attacks. Be cautious of unsolicited offers, and always verify the authenticity of the information and individuals involved in a project.

Unpredictable Technology: Web3 projects use new and advanced tech that might not be fully checked. This could lead to problems and money loss.

Liquidity Risks: Tokens acquired through pre-sales or investments may not have an active secondary market initially, which could limit your ability to buy, sell, or trade them.

Financial Advice: The information provided on our platform, including whitepapers, project details, and investment recommendations, should not be considered financial advice. You should consult with a qualified financial advisor before making any investment decisions.

You acknowledge and accept these risks by accessing and using Finceptor's investment platform. You agree to conduct due diligence and make investment decisions based on your own judgment. Finceptor does not assume any responsibility for your investment choices or the outcomes thereof.

Please remember that investing in cryptocurrencies and Web3 projects can be speculative and involves high risk. Only invest what you can afford to lose.

This disclaimer is designed to inform potential investors about the risks and considerations associated with participating in the Finceptor investment platform. However, it is advised to consult legal experts to ensure the disclaimer is appropriate for your specific circumstances and legal requirements.

Purchasing, holding, and transacting in any way with tokens shall not warrant, commit nor guarantee any revenue, profit, or value appreciation. Purchasing tokens shall not be construed as an investment. Token merely offers utilities and features within the project’s ecosystem and platforms. Finceptor reserves its right to amend and modify the utilities and features offered by the project.

Crypto and crypto assets transactions, including tokens, are very risky regarding potential losses, merchantability, technical failures, and legal and tax requirements. Indeed, the price of crypto assets can even become zero or be excessively volatile. By purchasing and holding or transacting in any way with the token, you agree and acknowledge that you undertake such risks on your own and shall consult your legal and tax consultants for compliance purposes.

We do not provide investment or financial advice, and all projects reviewed are done objectively in accordance with established reporting and information dissemination best practices. Before investing in any Web3-related project, you should conduct your research. As a result, Finceptor is not liable for any losses incurred due to a consumer’s investment decision.