Omnichain layer 1 AI infrastructure for token launch and DeFi operations

Registration Period

Guaranteed Allocation Round

Increase your allocation by staking more $FINC for longer.

First-Come-First-Serve Round

Proportional to guaranteed allocation.

Vesting Period

Deal Size

$100,000.00

Price

$0.03

1 GULL = $0.03

Loading...

Balance

Loading...

Invested

Loading...

Remaining Allocation

Loading...

Sale Metrics

Token Metrics

Table of Contents

- Introducing Gull Network

- Highlights

- Features & Products

- Revenue Streams

- Tokenomics & Token Utilities

- Marketing & User Acquisition Strategy

- Investors & Partnerships

- Disclaimer

Introducing Gull Network

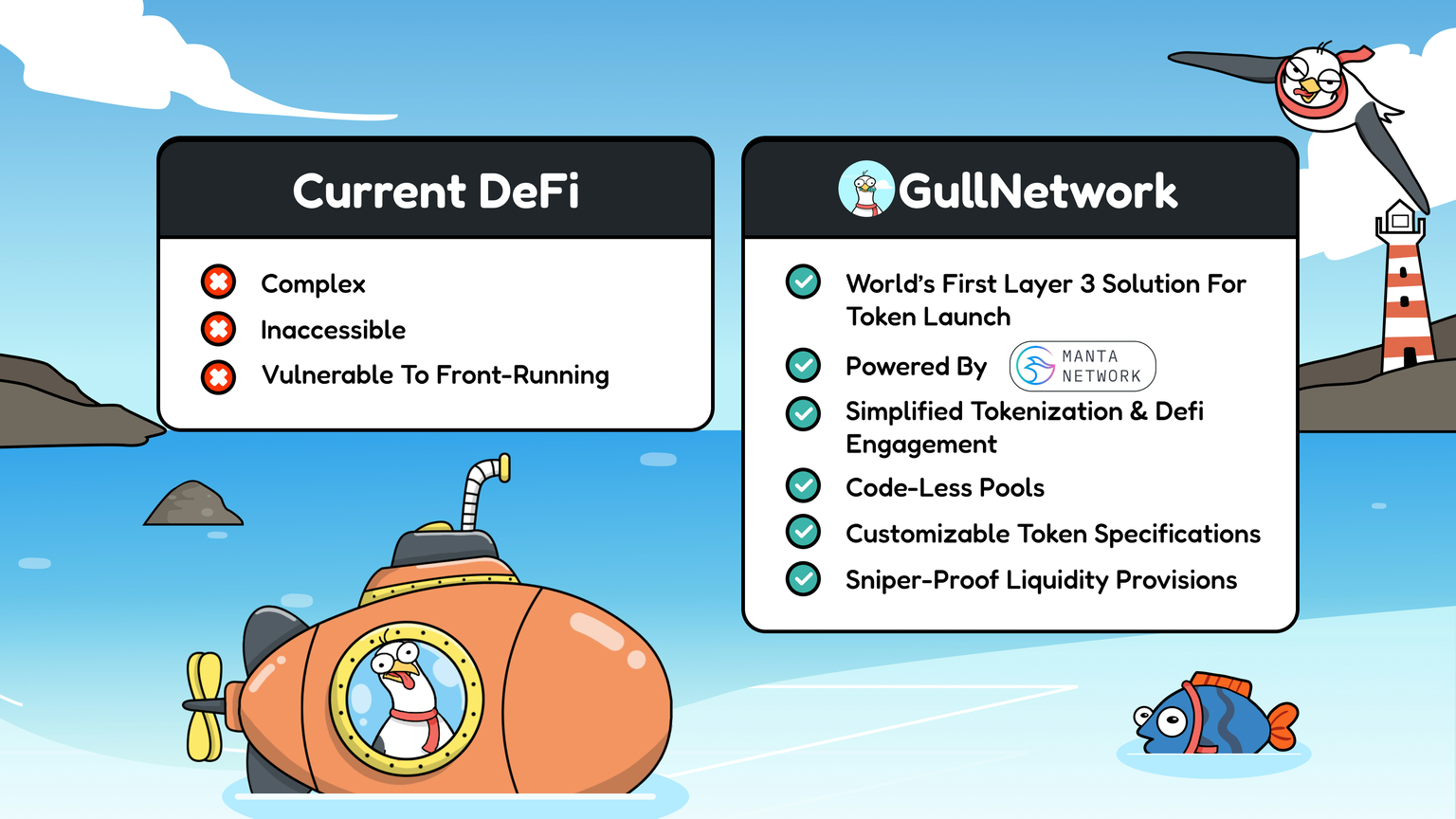

GullNetwork, a native DEX built on Manta Network, is revolutionizing DeFi with a platform designed for seamless token launches and management. By integrating with Manta, GullNetwork offers an open, decentralized ecosystem where anyone can participate through node operation and governance. Its powerful tools—like codeless pools, farms, and customizable token specs—make DeFi accessible, eliminating technical hurdles and simplifying complex financial operations for both new and experienced users.

What sets GullNetwork apart is its commitment to security and user experience. With unique sniper-proof liquidity provisions, Gull protects against front-running risks, fostering a fairer environment. The dedicated dApp streamlines tokenization, liquidity acquisition, and AMM setups, providing an intuitive gateway into DeFi. GullNetwork combines innovation and accessibility to break down barriers, empowering users to confidently engage in the DeFi landscape.

Highlights

-

Backed by Morningstar Ventures, GBV Capital, Manta Network, Maven Capital, Ozaru Ventures, and many more!

-

Currently holds $4.1M in total value locked on the protocol, with a peak of $8.2M in July!

-

Gull Network is the only native DEX on Manta Pacific, with official support from Manta and numerous unique features.

-

Reached over 125,000 individuals across social platforms in just half a year!

Features & Products

-

Swap: Trade tokens using Gull Network’s automated liquidity pools; if no direct pair exists, swaps are routed across available pairs, with routing details shown in the interface and multiple trading fees applied.

-

Pool: Add or remove liquidity for trading pairs on Gull Network, earning LP tokens representing your pool share, with incentives from trading fees and the option to stake LP tokens in farms for additional rewards.

-

Farm: Stake LP tokens on Gull Network to earn esGULL and additional rewards, distributed proportionally based on tokens staked and displayed in APR, with rewards allocated in tokens per second.

-

Fees: Each swap incurs a fee of 0.01% to 0.25%, with higher fees for volatile pairs, distributed between the Gull Network treasury and LPs; fee breakdowns are updated in real-time on the interface.

-

Structured Incentive Management: Add and configure incentives with auto-listing, adjustable liquidity rewards, and customizable schedules via interface.

-

Flexible Reward Management: Projects can boost APR anytime by adding reward tokens, allowing post-launch adjustments unique to GullNetwork.

-

Community Airdrop: Enable project-sponsored airdrops for liquidity providers, distributing approved tokens with minimal gas fees to reward active community participation.

-

Simplified Token Launching: Accessible tools for non-technical teams to customize tokenomics and implement features like airdrops, taxes, and burning without coding.

Revenue Streams

Gull Network’s business model generates revenue through fees from swaps, bridging, and liquid staking, shared between the treasury and liquidity providers. This structure incentivizes both platform growth and community engagement, supporting a sustainable, well-funded ecosystem.

Tokenomics & Token Utilities

-

Token Ticker: $GULL

-

Token Standard: ERC-20

-

Network: Ethereum

-

Total Supply: 500,000,000

-

Fully Diluted Valuation: $15,000,000

-

Initial Market Cap Without Liquidity: $933,375

-

Initial Market Cap: $1,383,375

Finceptor’s investors will participate in the Public Sale Round and will have 50% of their tokens available at launch.

$GULL Token Utilities:

-

Staking Rewards: Stake $GULL to earn tokens from new projects and support ecosystem growth.

-

Liquidity Provision: Provide $GULL for liquidity pools, earning fee shares and enhancing platform liquidity.

-

Farming: Stake LP tokens in farming to earn passive $GULL rewards and increase platform liquidity.

-

Governance Rights: Lock $GULL for veGULL to participate in governance votes and earn bribe rewards.

Marketing & User Acquisition Strategy

GullNetwork’s marketing and user acquisition strategy uses multi-seasonal engagement and community incentives to drive growth. Beginning with Season 1 airdrops, Gull will reward early adopters, fostering loyalty and creating initial momentum. Season 2 will expand this engagement by including NFT claims, adding exclusive value for participants and generating excitement.

To further attract users, Gull will offer a meme token launcher, empowering communities to create their own tokens and driving viral interest. An invitation code bonus, integration with Manta Network, and a point-based system with airdrop incentives will encourage participation and reward engagement, building a scalable, retention-focused ecosystem.

Investors & Partnerships

Disclaimer

Before you consider participating in any investment opportunities on Finceptor, please take a moment to read and understand the following important information. Investing in cryptocurrencies, Web3 projects, and participating in token sales involve inherent risks you should be aware of.

Risk of Loss: Investing in cryptocurrencies and Web3 projects carries a significant risk of financial loss. Prices of tokens and cryptocurrencies can be extremely volatile and unpredictable. You could lose all or a substantial portion of your investment.

Research: You are responsible for conducting thorough research before participating in any investment opportunity. This includes understanding the project's purpose, technology, team, and market potential. Do not invest solely based on hype or promises.

Regulatory Considerations: Cryptocurrencies and Web3 projects are subject to various regulatory frameworks in different jurisdictions. Regulatory changes could impact the legality and functioning of projects. Ensure you understand the legal implications in your country or region.

Scams and Fraud: The cryptocurrency space has been associated with scams, fraudulent schemes, and phishing attacks. Be cautious of unsolicited offers, and always verify the authenticity of the information and individuals involved in a project.

Unpredictable Technology: Web3 projects use new and advanced tech that might not be fully checked. This could lead to problems and money loss.

Liquidity Risks: Tokens acquired through pre-sales or investments may not have an active secondary market initially, which could limit your ability to buy, sell, or trade them.

Financial Advice: The information provided on our platform, including whitepapers, project details, and investment recommendations, should not be considered financial advice. You should consult with a qualified financial advisor before making any investment decisions.

You acknowledge and accept these risks by accessing and using Finceptor's investment platform. You agree to conduct due diligence and make investment decisions based on your own judgment. Finceptor does not assume any responsibility for your investment choices or the outcomes thereof.

Please remember that investing in cryptocurrencies and Web3 projects can be speculative and involves high risk. Only invest what you can afford to lose.

This disclaimer is designed to inform potential investors about the risks and considerations associated with participating in the Finceptor investment platform. However, it is advised to consult legal experts to ensure the disclaimer is appropriate for your specific circumstances and legal requirements.

Purchasing, holding, and transacting in any way with tokens shall not warrant, commit nor guarantee any revenue, profit, or value appreciation. Purchasing tokens shall not be construed as an investment. Token merely offers utilities and features within the project’s ecosystem and platforms. Finceptor reserves its right to amend and modify the utilities and features offered by the project.

Crypto and crypto assets transactions, including tokens, are very risky regarding potential losses, merchantability, technical failures, and legal and tax requirements. Indeed, the price of crypto assets can even become zero or be excessively volatile. By purchasing and holding or transacting in any way with the token, you agree and acknowledge that you undertake such risks on your own and shall consult your legal and tax consultants for compliance purposes.

We do not provide investment or financial advice, and all projects reviewed are done objectively in accordance with established reporting and information dissemination best practices. Before investing in any Web3-related project, you should conduct your research. As a result, Finceptor is not liable for any losses incurred due to a consumer’s investment decision.