Community-driven, early-stage venture capital investment and OTC DeFi platform for retail.

Registration Period

Guaranteed Allocation Round

Increase your allocation by staking more $FINC for longer.

First-Come-First-Serve Round

Proportional to guaranteed allocation.

Vesting Period

Deal Size

$200,000.00

Price

$0.01

1 LEGION = $0.01

Loading...

Balance

Loading...

Invested

Loading...

Remaining Allocation

Loading...

Sale Metrics

Token Metrics

Table of Contents

- Introducing Legion Ventures

- Highlights

- Features

- Roadmap

- Revenue Streams

- Tokenomics & Token Utilities

- Marketing & User Acquisition Strategy

- Team

- Investors & Partnerships

- Disclaimer

Introducing Legion Ventures

Introducing Legion Ventures, a pioneering force in the investment and OTC DeFi realm, offering a unique platform explicitly designed for retail traders. The peer-to-peer trading system, facilitated by smart contracts, ensures transparent and efficient transactions. With over 15 top-tier projects available for investment, including Celestia, LayerZero, SEI, ZetaChain, and more, Legion Ventures provides unparalleled opportunities for early-stage investment in high-quality Web3 projects. Holding the $LEGION token not only grants access to revenue sharing but also opens doors to additional revenue streams through owning specific NFTs and participating in governance within the DAO. At Legion Ventures, security is paramount, with a flawless track record in fund management and an NFT collection that boasts 90% original ownership.

Embracing innovation and challenging traditional investment practices, Legion Ventures has created a revolutionary OTC marketplace where users can trade allocations freely. Its mission is clear: to democratize investment access, empower retail investors, and drive forward a transformative vision for the future of finance.

Highlights

-

Over 160 successful investments made.

-

Currently onboarded over 12,000 investors.

-

Deployed $13M in projects, with $9M distributed and counting.

-

Established a growing network encompassing VCs, exchanges, and projects.

-

Maintained an impeccable security record.

-

Generated revenue exceeding $1.3M.

-

Witnessed a steady increase in website traffic over the last few months, with a remarkable 682% surge in January and ongoing growth.

-

Accumulated more than 200K website visitors in the last three months across the two websites.

-

Fostered a vast community comprising 115k individuals across various platforms.

Features

-

Circular Economy: Legion Ventures operates within a closed-loop economy, where all generated value circulates back into the system to benefit both the platform and its users. Unlike traditional platforms, all gains derived from transactions fees and investment revenues are reinvested within the ecosystem, ensuring continuous growth while rewarding loyal users.

-

Value Inflow and Outflows: Value flows into the economy primarily through transaction fees on all trade and investment transactions, as well as revenue from the Community and LV Fund. Conversely, value exits the economy through revenue-share payouts, a deflationary buy-back and burn mechanism, and rewards and incentive programs, fostering a self-sustaining economic model.

-

Community Fund: Legion Ventures allocates platform fees to the Community Fund, ensuring that 50% of all trade revenue and investment transactions contribute to community growth and development. Governed by NFT holders through the Council, the Community Fund's initial purpose is to distribute revenue back to holders. However, once the Council is established, it gains the flexibility to allocate funds towards various initiatives, such as covering losses from failed investments, investing in new projects, or executing buyback and burn mechanisms.

-

Democratised Access: Legion Ventures provides vetted, early-stage deal flow and a marketplace for unlisted airdrops, accessible to all investors. NFT holders enjoy additional privileges, including the ability to invest, participate in governance, and influence the platform's future direction. With voting power proportionate to their NFT holdings, NFT holders play a crucial role in shaping Legion Ventures' trajectory.

-

Liquidity and Flexibility: Investors on the Legion Ventures platform have the freedom to sell some or all of their investments at any time, ensuring liquidity and flexibility in managing their portfolios. This feature addresses the historical challenge of maintaining liquidity while funds are deployed, offering investors greater control over their investments and enhancing overall user experience.

-

[NFTs]{.underline}, Gateway to High-Quality Allocations: As an NFT holder, holders gain access to high-quality allocations in top-tier projects, transcending the limitations of small allocations and volatile token prices on traditional launchpad platforms. Enjoying discounted fees on the Legion Platform, revenue sharing from the Legion Fund, and no trading fees until the NFT's value is reached. With 600 unique NFTs across four tiers, each tier offers specific benefits tailored to varying investment preferences and capabilities. At Legion, NFT ownership signifies community ownership and influence over the platform's direction, emphasizing collaboration, ownership, and unprecedented opportunities in the crypto space.

-

DAO: The DAO empowers NFT holders to govern and shape the platform's future, ensuring that changes and initiatives align with the community's best interests. While decentralization remains a primary objective, the platform recognizes the importance of balancing decentralization with efficiency to ensure effective operation.

-

Council: The Council serves as a vital component within Legion Ventures' DAO governing and management system, responsible for implementing proposals and overseeing the platform's operations. Comprising five members, each representing a tier of the NFT Collection, the Council acts as the 'management team,' serving as gatekeepers of the Treasury and Distribution Wallet. Four members are elected for a one-year mandate, with a new voting process commencing at the end of each term. The fifth member, drawn from the previous team, provides continuity and expertise. Eligibility for a Council position requires ownership of at least one NFT and holding a minimum of 0.1% of the total $LEGION supply, locked until the end of the term. Council members enjoy various benefits, including free $LEGION tokens, exclusive access to information, and invaluable expertise from an extensive network, ensuring effective governance and strategic decision-making within the Legion Ventures ecosystem.

Roadmap

Legion Ventures has outlined an ambitious roadmap spanning various developmental milestones over the coming months and years. In the short term, they have already implemented key features such as the contribution process and smart contracts for their OTC Marketplace, with audits scheduled for February to ensure robust security standards. In February, they introduced an OTC Marketplace tailored specifically for airdrops, along with enhanced analytics capabilities.

Moving forward, their focus will be on expanding the OTC Marketplace, developing utility features for the $LEGION token, and fostering strategic partnerships and community collaborations, including engagements with KOLs.

Over the next 12-36 months, Legion Ventures aims to broaden its investment offerings, integrate cutting-edge Web3.0 technologies, and further refine the $LEGION token ecosystem. They remain committed to community-driven initiatives, inclusivity, and transparency, with plans to implement DAO governance for NFT holders, establish council members, and unveil new products under the Legion Umbrella, demonstrating their dedication to continuous growth and innovation.

Revenue Streams

Legion Ventures boasts a simple yet powerful business model, value primarily flows into the economy through:

-

Platform transaction fees on all trade and investment transactions (5% for trading - buyer and seller- and 10% for investing).

-

Revenue from the Community and LV Fund.

Tokenomics & Token Utilities

-

Token name: Legion

-

Token Ticker: $LEGION

-

Token Standard: ERC-20

-

Network: Ethereum

-

Total Supply: 1,000,000,000

-

Fully Diluted Valuation: $10,000,000

-

Initial Market Cap Without Liquidity: $412,500

-

Initial Market Cap: $712,500

Finceptor's investors will participate in the Public Round and will have 15% of their tokens available at launch.

$LEGION plays a crucial role within the Legion Ventures Ecosystem, offering diverse functionalities:

-

Paying transaction fees with a discount instead of paying in stablecoins.

-

The $LEGION tokens used for paying the fee will be automatically burned, thus providing a continuous burning mechanism that will reduce the fixed supply of the $LEGION token.

-

Stake $LEGION tokens to get more discount in transaction fees.

-

Reducing platform fees when buying or selling an allocation.

-

Earn rewards for participation, learning and promotion.

-

Become eligible to earn passive income from the Community Fund through staking

Marketing & User Acquisition Strategy

Legion Ventures has devised a multifaceted marketing and user acquisition strategy aimed at maximizing visibility and engagement. Their approach includes multiple airdrop campaigns conducted on platforms such as Galxe, Port3, Zealy, and Dmission, coupled with strategic partnerships with Decubate, Chappyz, and MagicSquare to amplify awareness of these campaigns and host various giveaways. Leveraging KOLs to promote the platform through Twitter threads adds a personal touch and enhances credibility within the community.

Additionally, Legion Ventures has secured partnerships with prominent entities like BSC.News and BNB Chain, leveraging them as marketing partners to disseminate content across social media channels effectively. Complementing these efforts are referral campaigns tailored for Telegram users, fostering organic growth through incentivized word-of-mouth marketing.

This comprehensive approach underscores Legion Ventures' commitment to building a robust ecosystem and driving sustainable user acquisition.

Team

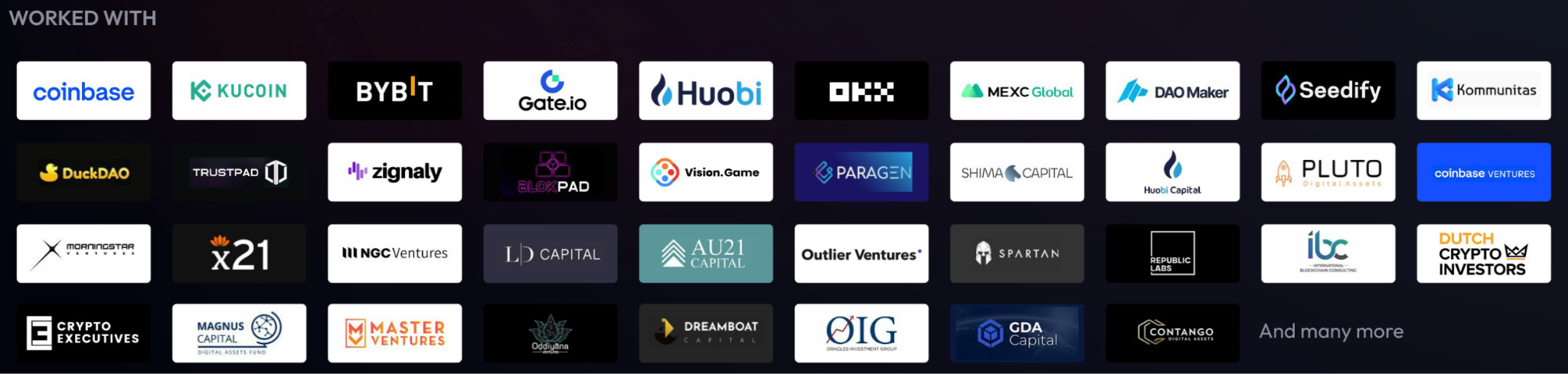

Investors & Partnerships

Legion Ventures has forged a robust network of partnerships to bolster its venture endeavors. The audit, entrusted to Hacken, ensures the integrity and security of its operations. Acheron's market-making expertise provides liquidity and stability to its token ecosystem. In terms of launchpad collaborations, Legion Ventures has aligned with Finceptor, YAY Network, SuperLauncher, and Paragen, amplifying its exposure and access to diverse investor communities. Metabros' incubation support further strengthens its developmental capabilities. Token management is entrusted to Kaizen Finance, ensuring efficient governance and utility.

Additionally, strategic alliances with Side.xyz, LayerZero Labs, Trailblazexyz, BNB Chain, 10n8 BRC-20, Magic Square, Oddiyana VC, Sheesha Finance, AIT Protocol, Chappyz, FD Capital, and Bybit augment Legion Ventures' reach, innovation, and potential for growth.

Disclaimer

Before you consider participating in any investment opportunities on Finceptor, please take a moment to read and understand the following important information. Investing in cryptocurrencies, Web3 projects, and participating in token sales involve inherent risks you should be aware of.

Risk of Loss: Investing in cryptocurrencies and Web3 projects carries a significant risk of financial loss. Prices of tokens and cryptocurrencies can be extremely volatile and unpredictable. You could lose all or a substantial portion of your investment.

Research: You are responsible for conducting thorough research before participating in any investment opportunity. This includes understanding the project's purpose, technology, team, and market potential. Do not invest solely based on hype or promises.

Regulatory Considerations: Cryptocurrencies and Web3 projects are subject to various regulatory frameworks in different jurisdictions. Regulatory changes could impact the legality and functioning of projects. Ensure you understand the legal implications in your country or region.

Scams and Fraud: The cryptocurrency space has been associated with scams, fraudulent schemes, and phishing attacks. Be cautious of unsolicited offers, and always verify the authenticity of the information and individuals involved in a project.

Unpredictable Technology: Web3 projects use new and advanced tech that might not be fully checked. This could lead to problems and money loss.

Liquidity Risks: Tokens acquired through pre-sales or investments may not have an active secondary market initially, which could limit your ability to buy, sell, or trade them.

Financial Advice: The information provided on our platform, including whitepapers, project details, and investment recommendations, should not be considered financial advice. You should consult with a qualified financial advisor before making any investment decisions.

You acknowledge and accept these risks by accessing and using Finceptor's investment platform. You agree to conduct due diligence and make investment decisions based on your own judgment. Finceptor does not assume any responsibility for your investment choices or the outcomes thereof.

Please remember that investing in cryptocurrencies and Web3 projects can be speculative and involves high risk. Only invest what you can afford to lose.

This disclaimer is designed to inform potential investors about the risks and considerations associated with participating in the Finceptor investment platform. However, it is advised to consult legal experts to ensure the disclaimer is appropriate for your specific circumstances and legal requirements.

Purchasing, holding, and transacting in any way with tokens shall not warrant, commit nor guarantee any revenue, profit, or value appreciation. Purchasing tokens shall not be construed as an investment. Token merely offers utilities and features within the project's ecosystem and platforms. Finceptor reserves its right to amend and modify the utilities and features offered by the project.

Crypto and crypto assets transactions, including tokens, are very risky regarding potential losses, merchantability, technical failures, and legal and tax requirements. Indeed, the price of crypto assets can even become zero or be excessively volatile. By purchasing and holding or transacting in any way with the token, you agree and acknowledge that you undertake such risks on your own and shall consult your legal and tax consultants for compliance purposes.

We do not provide investment or financial advice, and all projects reviewed are done objectively in accordance with established reporting and information dissemination best practices. Before investing in any Web3-related project, you should conduct your research. As a result, Finceptor is not liable for any losses incurred due to a consumer's investment decision.