A non-custodial DeFi protocol leading single-token strategies for DeFi liquidity

The tokenomics is currently under review and subject to change; therefore, the token price and amount have been temporarily set to zero.

Registration Period

Guaranteed Allocation Round

Increase your allocation by staking more $FINC for longer.

First-Come-First-Serve Round

Proportional to guaranteed allocation.

Vesting Period

Deal Size

$1.00

Price

$0.00

1 LOB = $0.00

Loading...

Balance

Loading...

Invested

Loading...

Remaining Allocation

Loading...

Sale Metrics

Token Metrics

Table of Contents

- Introducing Lobster

- Highlights

- Features & Products

- Roadmap

- Revenue Streams

- Tokenomics & Token Utilities

- Marketing & User Acquisition Strategy

- Team

- Disclaimer

Introducing Lobster

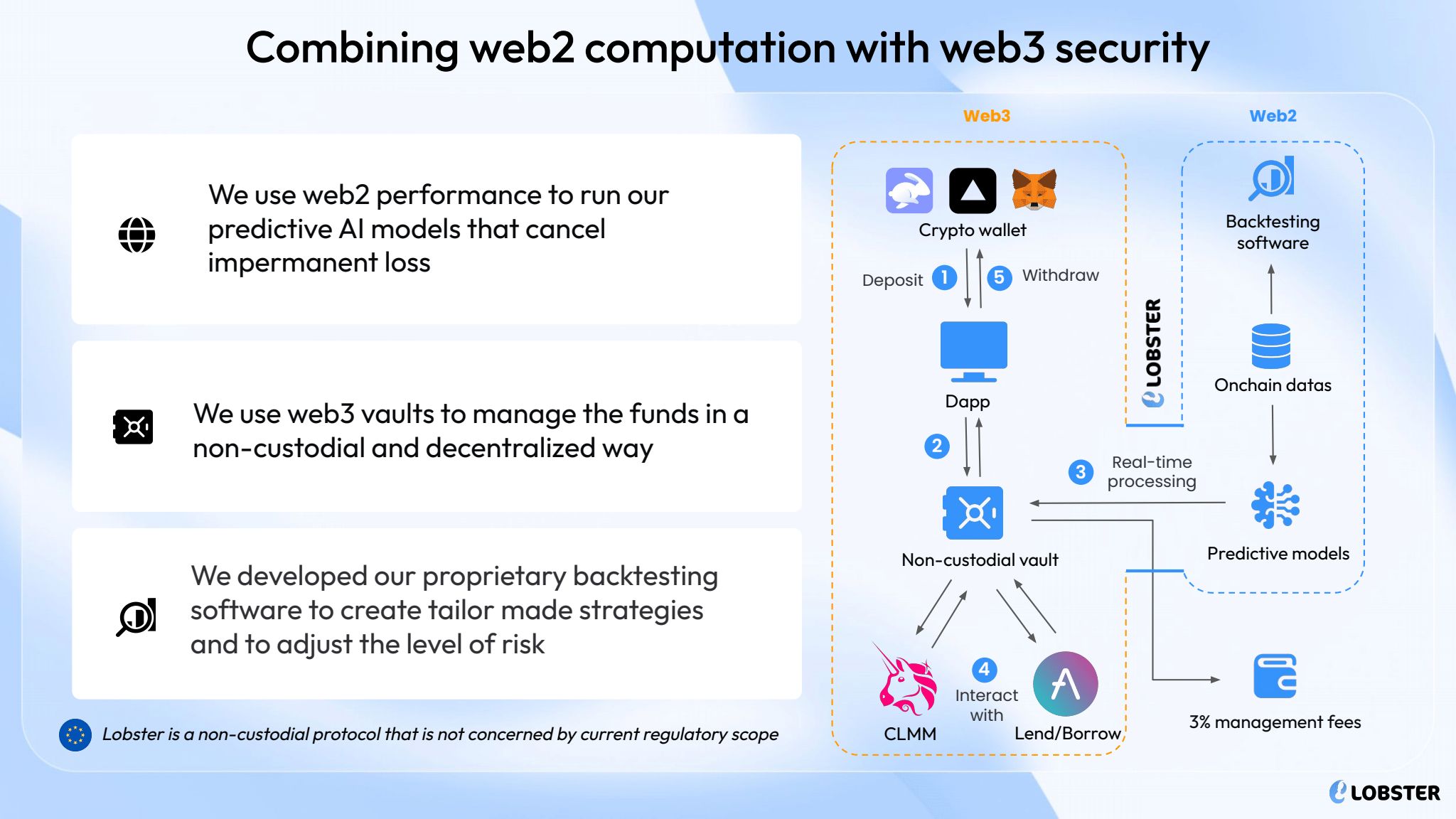

Lobster is a non-custodial DeFi protocol designed to simplify and enhance crypto investment strategies. Built as an overlay for various underlying services like lending and liquidity providing, Lobster aggregates these tools to create fully automated, market-neutral strategies accessible through a single deposit. Its goal is to provide DeFi investors with optimized returns while minimizing risks and eliminating the complexity that often deters users from engaging in decentralized finance.

Lobster’s innovative approach focuses on overcoming two major challenges in DeFi: the steep learning curve and impermanent loss. Through advanced algorithmic models and concentrated liquidity pool technology, Lobster mitigates impermanent loss, allowing users to achieve higher returns without the need for continuous manual management. Investors can now deposit a single asset into a vault and leverage sophisticated strategies without dealing with the intricacies of traditional liquidity pools. Lobster’s strategy automation and robust risk management make it a game-changing solution for those seeking sustainable and profitable yield in the evolving DeFi landscape.

Highlights

-

Already live strategies have onboarded over $250,000 in TVL for their first WETH strategy in 3 months from their launch.

-

Attracted over 80 contributors to the TVL, with a conversion rate of over 20%.

-

Accelerated and backed by Hypernest Labs.

-

Part of 50 partners’ Web3 incubator, the top Web3 accelerator in France.

-

First participant in Finceptor’s Inception program.

-

Established partnerships with leading DeFi names like Thena Labs, dHedge, Gate Web3 Wallet, and TRAKX.

-

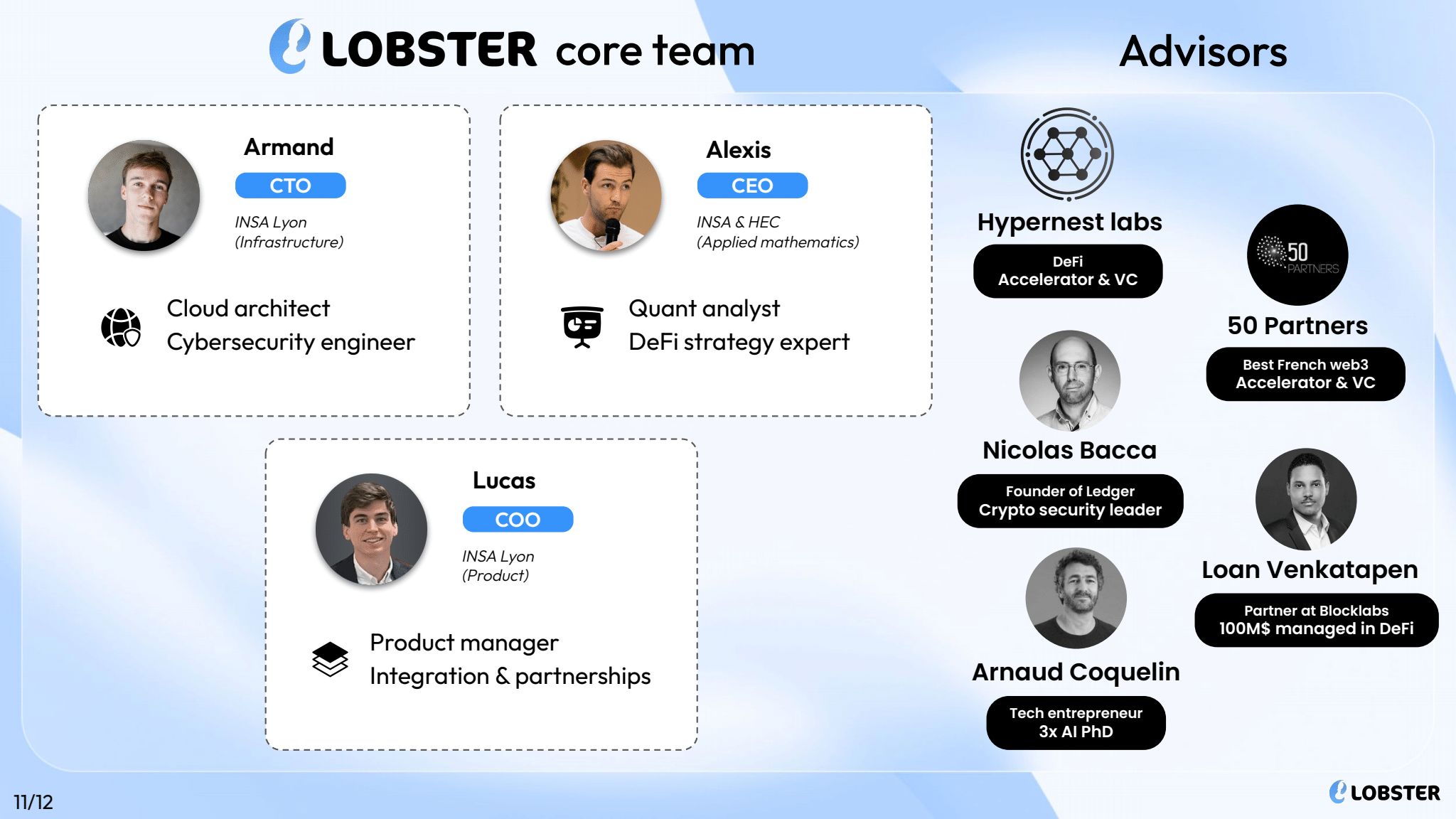

Developed by an Expert Tech & Quant Team!

Features & Products

-

Multi-layered Architecture: Lobster’s infrastructure consists of three key layers: the user interface (Lobster App), liquidity management (Lobster Vaults), and strategy execution (Lobster Algorithm), designed to optimize workflow and user interaction.

-

Non-Custodial Vaults: The platform uses blockchain-based smart contracts to ensure secure, non-custodial handling of user funds, allowing only specific, predefined operations like liquidity provision on Uniswap V3 and lending on AAVE.

-

Immutable Algorithms: Lobster’s algorithms run in autonomous virtual machines, which are immutable and self-contained, ensuring secure and consistent strategy execution based on market conditions.

-

Single Asset Yield: Lobster’s vaults are designed to allow deposits in a single token, generating yield through liquidity pool technology.

-

Market-Neutral Exposure: Strategies use techniques to eliminate exposure to the second token in liquidity pools, maintaining market neutrality.

-

Impermanent Loss Management: Utilizes concentrated liquidity pool technology (CLMM) to minimize impermanent loss on positions.

-

Frequent Rebalancing: Micro-transactions and rebalancing across multiple protocols ensure optimal strategy performance and continuity.

-

Optimized Allocation: Strategic distribution of assets, prioritizing yield generation on Uniswap and hedging on AAVE for risk management.

-

Resilient Performance: Robust management of the borrow ratio to stay below liquidation thresholds, ensuring consistent performance without margin call losses.

Roadmap

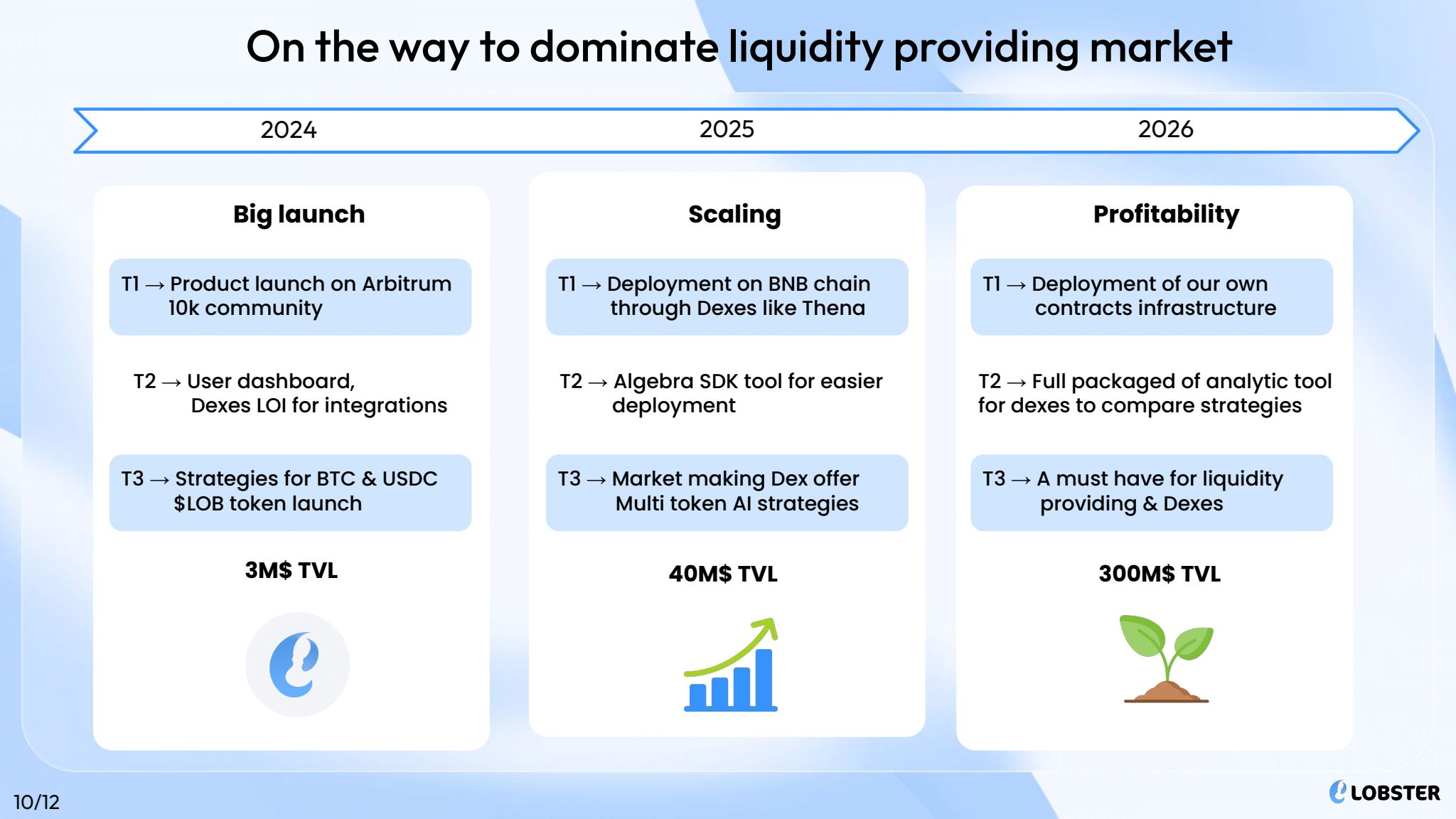

Lobster’s roadmap outlines a strategic development plan starting with research, algorithm development, and a proof of concept in 2023, followed by automated strategy launches and community growth in early 2024. It includes the rollout of its platform on Arbitrum, Ethereum, and other major chains, partnerships with DApps and VASPs, and the integration of AI in algorithmic models. By 2025, the focus shifts to expanding strategy offerings, launching a native token, and positioning as a key player in decentralized finance with an architecture open to other decentralized applications.

Revenue Streams

Lobster’s business model centers on a 3% annual management fee on the total value locked (TVL) in the protocol, deducted in small increments every 4 hours. This fee structure is designed to ensure transparency and is already factored into the performance metrics displayed to users, with no additional charges applied throughout the investment’s lifetime.

Tokenomics & Token Utilities

-

Token Ticker: $LOB

-

Token Standard: TBA

-

Network: TBA

-

Total Supply: TBA

-

Fully Diluted Valuation: TBA

-

Initial Market Cap Without Liquidity: TBA

-

Initial Market Cap: TBA

The $LOB token is utilized in the Lobster ecosystem by:

-

Governance: Staking $LOB tokens grants voting rights on Lobster’s DAO for strategic decisions, protocol improvements, and strategy creation.

-

Exclusive Vault Access: Premium users staking $LOB can access high-profit vaults with limited market liquidity and special investment slots.

-

Yield Generation: Staking $LOB tokens generates yield, incentivizing further staking.

-

Recipe Token Staking: Locking recipe tokens for longer periods provides higher incentives on the related strategy, enhancing community engagement.

-

Buyback & Burn: A portion of protocol profits is used for a buyback and burn mechanism, increasing the token’s value over time.

Marketing & User Acquisition Strategy

Lobster employs a dual-focused marketing strategy targeting both B2C and B2B clients. For B2C, Lobster utilizes social networks, growth marketing techniques, and AMAs (Ask Me Anything) sessions to reach individual investors. The strategy is reinforced by a marketing consultancy that helps build active communities on platforms like Twitter, Discord, and Telegram. Engagement campaigns, such as Points into Token and Quest activities, are designed to attract and retain retail users by rewarding their participation. On the B2B side, Lobster focuses on networking, presentations, and event participation to engage crypto professionals and businesses. Sales are further amplified through automation tools and data scraping techniques. Targeting crypto firms with under $500M AUM, Lobster co-creates customized strategies for these clients while also exploring B2B2C integrations, such as the collaboration with Thena Labs for liquidity management. By leveraging the social proof and active engagement of its B2C community, Lobster builds credibility to close larger-scale B2B deals.

Team

Disclaimer

Before you consider participating in any investment opportunities on Finceptor, please take a moment to read and understand the following important information. Investing in cryptocurrencies, Web3 projects, and participating in token sales involve inherent risks you should be aware of.

Risk of Loss: Investing in cryptocurrencies and Web3 projects carries a significant risk of financial loss. Prices of tokens and cryptocurrencies can be extremely volatile and unpredictable. You could lose all or a substantial portion of your investment.

Research: You are responsible for conducting thorough research before participating in any investment opportunity. This includes understanding the project's purpose, technology, team, and market potential. Do not invest solely based on hype or promises.

Regulatory Considerations: Cryptocurrencies and Web3 projects are subject to various regulatory frameworks in different jurisdictions. Regulatory changes could impact the legality and functioning of projects. Ensure you understand the legal implications in your country or region.

Scams and Fraud: The cryptocurrency space has been associated with scams, fraudulent schemes, and phishing attacks. Be cautious of unsolicited offers, and always verify the authenticity of the information and individuals involved in a project.

Unpredictable Technology: Web3 projects use new and advanced tech that might not be fully checked. This could lead to problems and money loss.

Liquidity Risks: Tokens acquired through pre-sales or investments may not have an active secondary market initially, which could limit your ability to buy, sell, or trade them.

Financial Advice: The information provided on our platform, including whitepapers, project details, and investment recommendations, should not be considered financial advice. You should consult with a qualified financial advisor before making any investment decisions.

You acknowledge and accept these risks by accessing and using Finceptor's investment platform. You agree to conduct due diligence and make investment decisions based on your own judgment. Finceptor does not assume any responsibility for your investment choices or the outcomes thereof.

Please remember that investing in cryptocurrencies and Web3 projects can be speculative and involves high risk. Only invest what you can afford to lose.

This disclaimer is designed to inform potential investors about the risks and considerations associated with participating in the Finceptor investment platform. However, it is advised to consult legal experts to ensure the disclaimer is appropriate for your specific circumstances and legal requirements.

Purchasing, holding, and transacting in any way with tokens shall not warrant, commit nor guarantee any revenue, profit, or value appreciation. Purchasing tokens shall not be construed as an investment. Token merely offers utilities and features within the project’s ecosystem and platforms. Finceptor reserves its right to amend and modify the utilities and features offered by the project.

Crypto and crypto assets transactions, including tokens, are very risky regarding potential losses, merchantability, technical failures, and legal and tax requirements. Indeed, the price of crypto assets can even become zero or be excessively volatile. By purchasing and holding or transacting in any way with the token, you agree and acknowledge that you undertake such risks on your own and shall consult your legal and tax consultants for compliance purposes.

We do not provide investment or financial advice, and all projects reviewed are done objectively in accordance with established reporting and information dissemination best practices. Before investing in any Web3-related project, you should conduct your research. As a result, Finceptor is not liable for any losses incurred due to a consumer’s investment decision.