A Bitcoin Protocol to trade, bridge, launch, earn, borrow, and lend.

Registration Period

Guaranteed Allocation Round

Increase your allocation by staking more $FINC for longer.

First-Come-First-Serve Round

Proportional to guaranteed allocation.

Vesting Period

Deal Size

$200,000.00

Price

$0.085

1 O4DX = $0.085

Loading...

Balance

Loading...

Invested

Loading...

Remaining Allocation

Loading...

Sale Metrics

Token Metrics

Table of Contents

- Introducing OrangeDX

- Features & Products

- Roadmap

- Revenue Streams

- Tokenomics & Token Utilities

- Marketing & User Acquisition Strategy

- Team

- Investors & Partnerships

- Disclaimer

Introducing OrangeDX

OrangeDX emerges as a pioneering platform within the DeFi arena, integrating seamlessly with the Bitcoin protocol to offer users unparalleled opportunities in trading, swapping, bridging, and launching innovative BRC-20 projects.

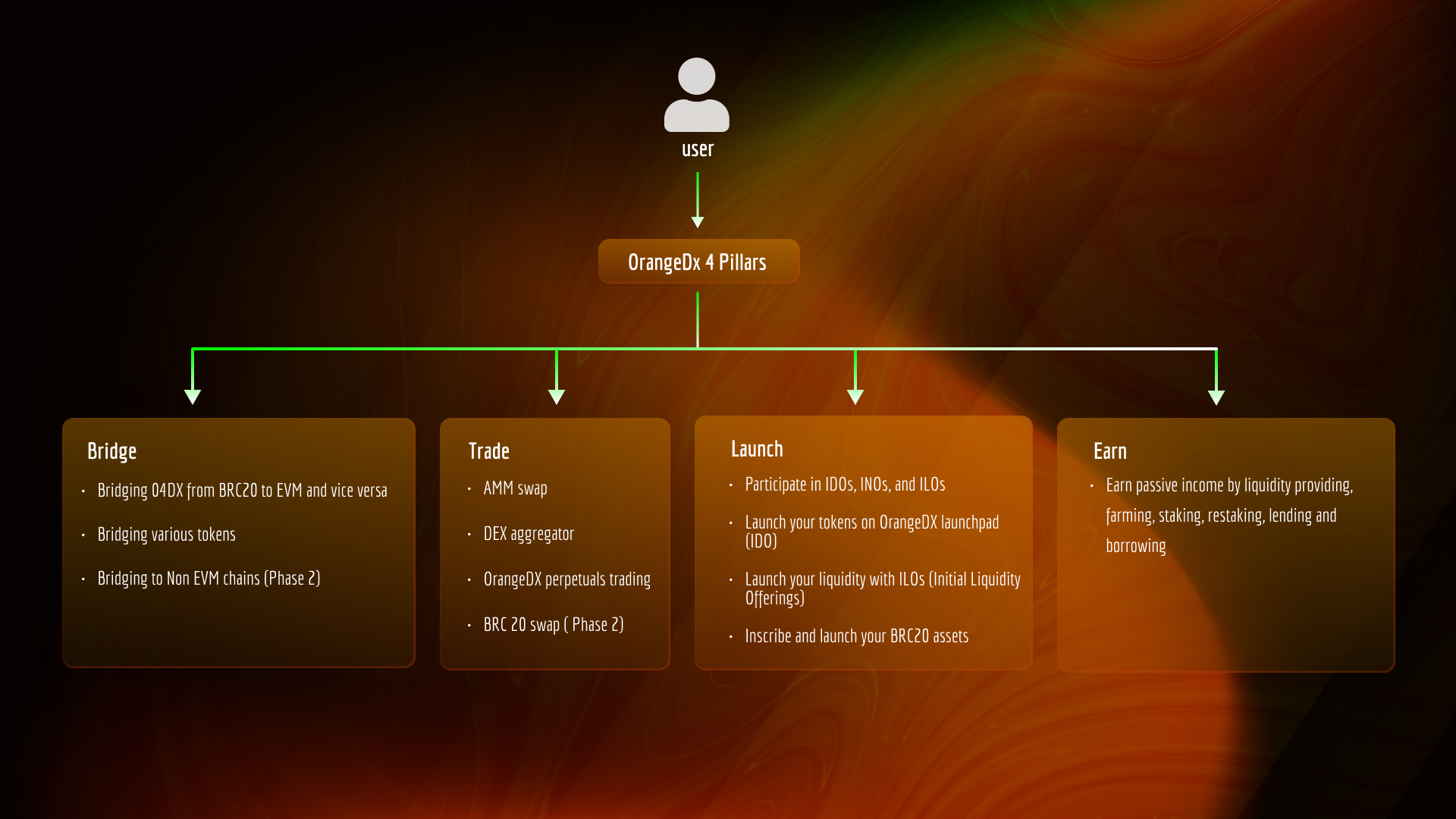

OrangeDX stands on four robust pillars: Bridge, Trade, Launch, and Earn, each meticulously designed to cater to the diverse needs of its users. The platform's Bridge pillar facilitates effortless transfers between the Bitcoin network and EVM chains, while its Trade component introduces an innovative AMM swap system. Additionally, OrangeDX's Launchpad and Earn pillars provide avenues for users to debut projects and engage in various DeFi activities, all underpinned by a commitment to decentralized governance through its DAO. By amalgamating the security of Bitcoin with the dynamic capabilities of DeFi, OrangeDX positions itself as a pivotal player in reshaping the financial landscape on Bitcoin.

Driven by a vision to become the preeminent gateway to a thriving BRC-20 ecosystem, OrangeDX aims to empower users of all experience levels to access and leverage the full spectrum of DeFi opportunities. Its mission revolves around democratizing DeFi by simplifying complexities, fostering innovation within BRC-20 projects, and ensuring robust security for user assets. Through responsible governance and clear practices, OrangeDX seeks to drive sustainable growth in the Bitcoin ecosystem while distinguishing itself as a powerhouse in the decentralized finance space.

Features & Products

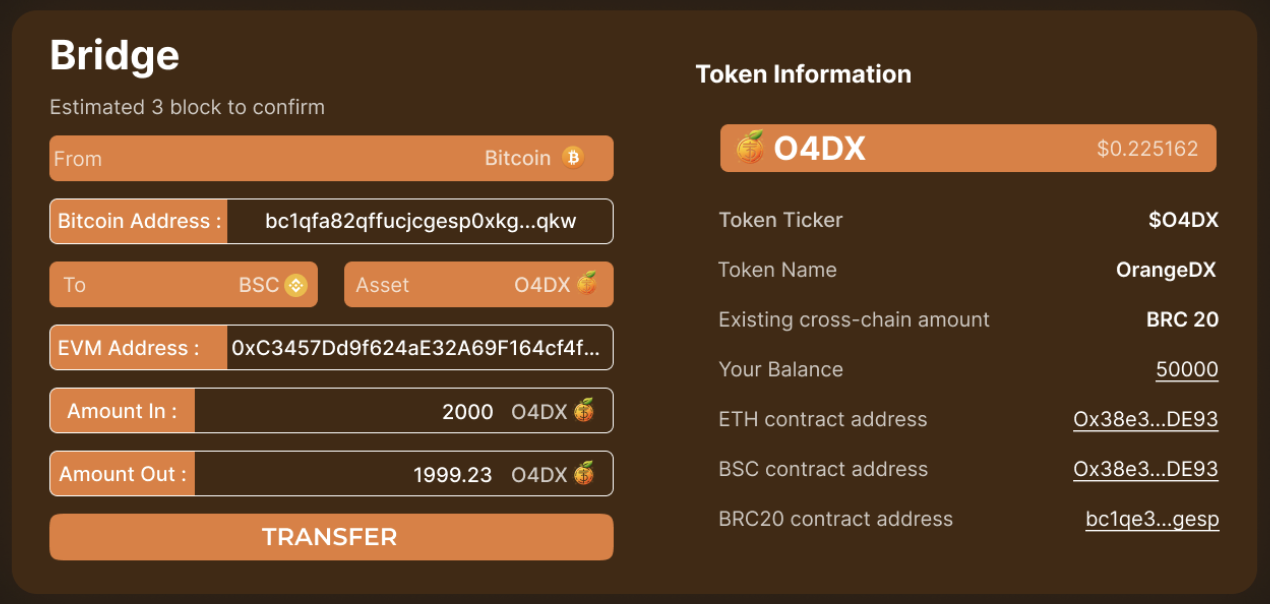

Bridge: Facilitates seamless transfers from the Bitcoin network to EVM chains, with plans for future expansion to include additional blockchain networks from Non- EVM chains to bitcoin layer-2 chains.

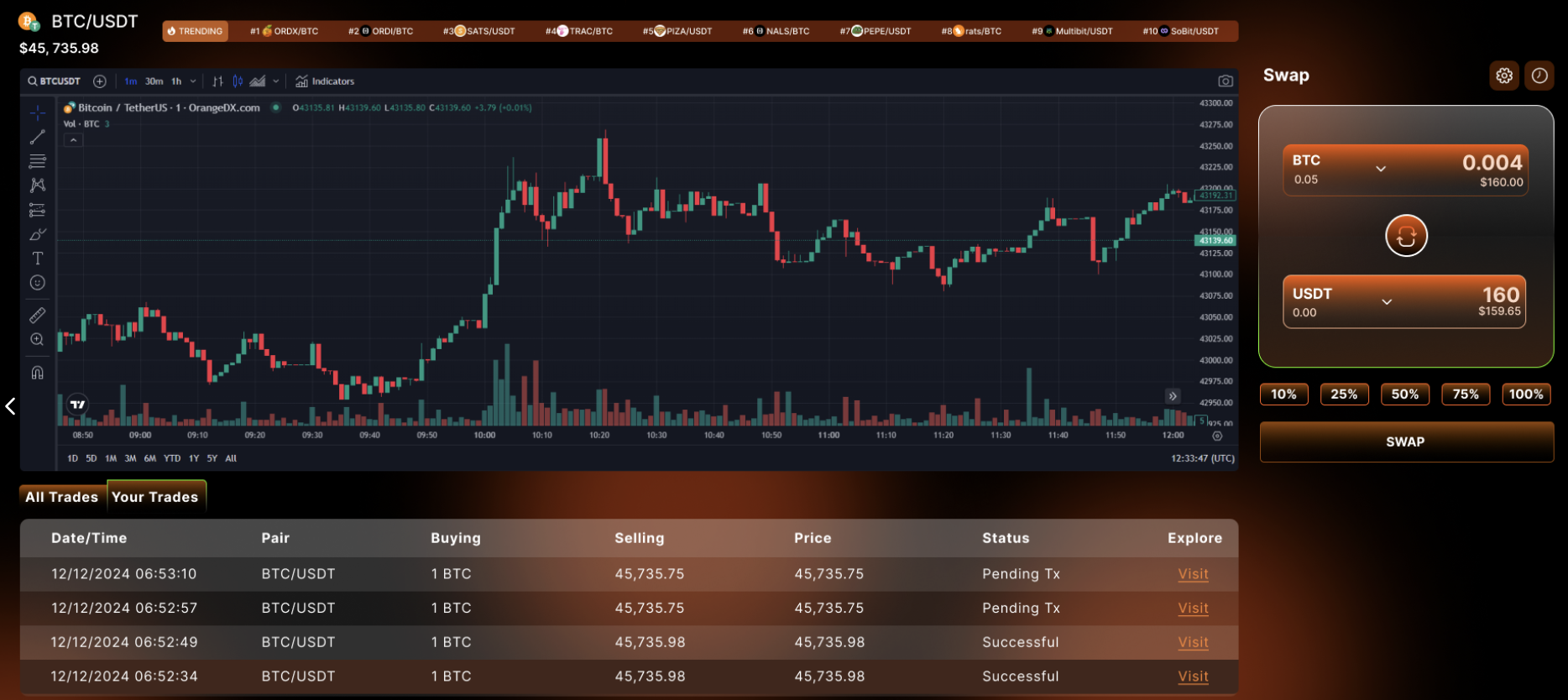

Trade: Introduces an Automated Market Maker swap engine employs an advanced Constant Function Market Maker, distinguished by its integration of real-time charts to provide a user-friendly trading experience. By providing analytical tools alongside the AMM swap system, OrangeDX ensures that users can make informed trading decisions within a seamless, intuitive platform.

Perpetuals Trading: Perpetual trading platform allow users to add liquidity to a single-sided pool, such as an O4DX pool, through on-chain transactions, using their contributions as collateral for perpetual trading against major assets like Bitcoin or Ethereum. This system enables users to execute multiple trades without transaction gas fees, with the option for users to set up stop losses to mitigate risks or face potential liquidation.

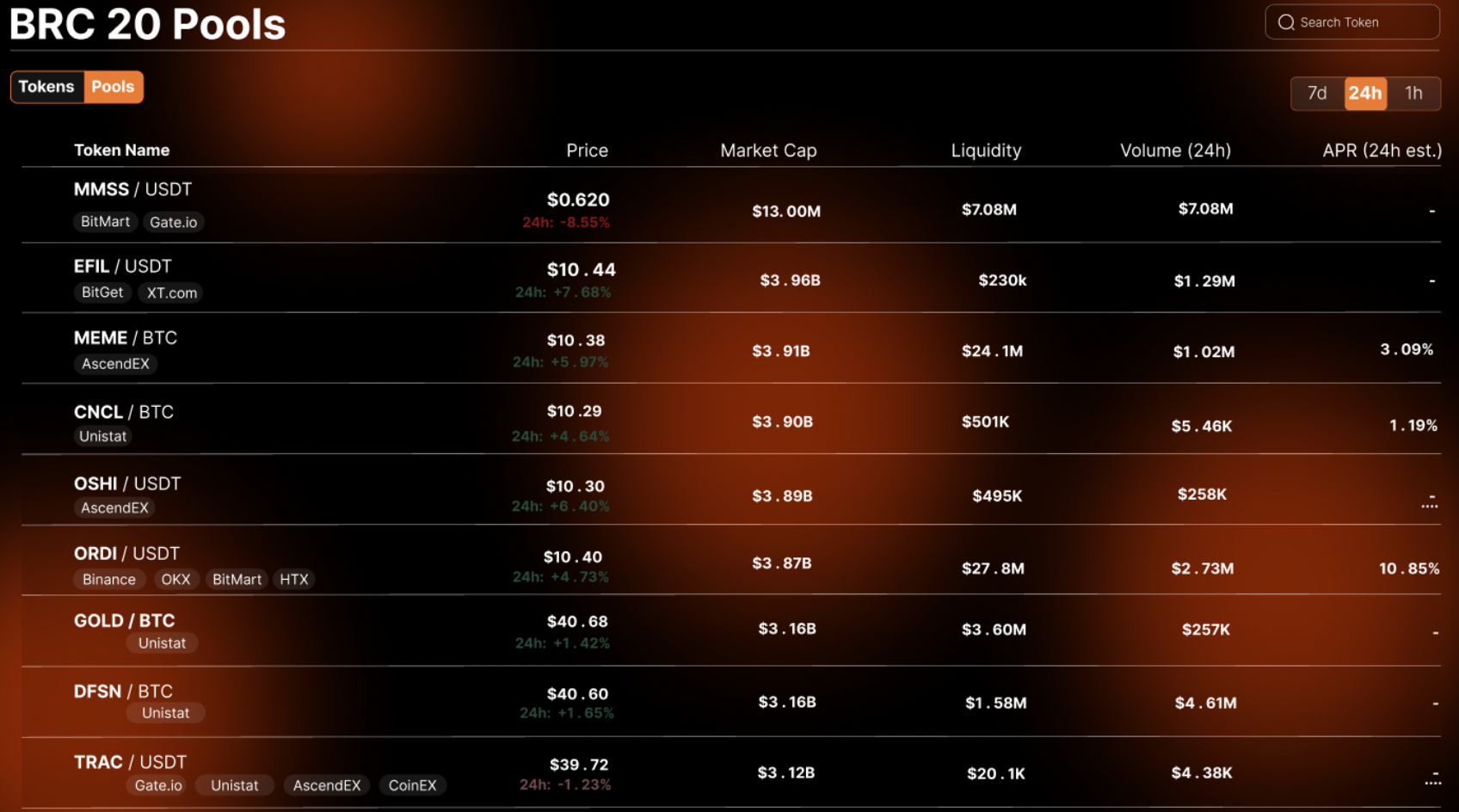

DEX Aggregator: OrangeDX revolutionizes BRC-20 trading with its DEX aggregator, simplifying the DeFi experience by eliminating the need to jump between exchanges. This tool unifies liquidity from top BRC-20 platforms into one easy-to-use interface, ensuring you find the best prices with its intelligent market-scanning algorithm.

Marketplace/Aggregator: OrangeDX's BRC20 Marketplace lists native chain BRC20 projects, allowing users to buy and sell on the Bitcoin native chain. This enables peer-to-peer trading and grants users access to rare BRC20 tokens. The Market place will be complemented with a marketplace aggregator which would aggregate the major BRC20 tokens listed on various platforms.

Markets Data: Markets platform brings together real-time data from the BRC-20 ecosystem into a single view, eliminating the need for multiple tabs and scattered information. It provides consolidated intelligence, enabling users to track prices, volumes, liquidity, and other key metrics across various BRC-20 exchanges and protocols in one place. With advanced visualization tools and analytics, it reveals market trends, uncovers opportunities, and supports informed trading strategies. Users can customize their dashboards to focus on vital investment data and stay updated with real-time alerts on price shifts and market events.

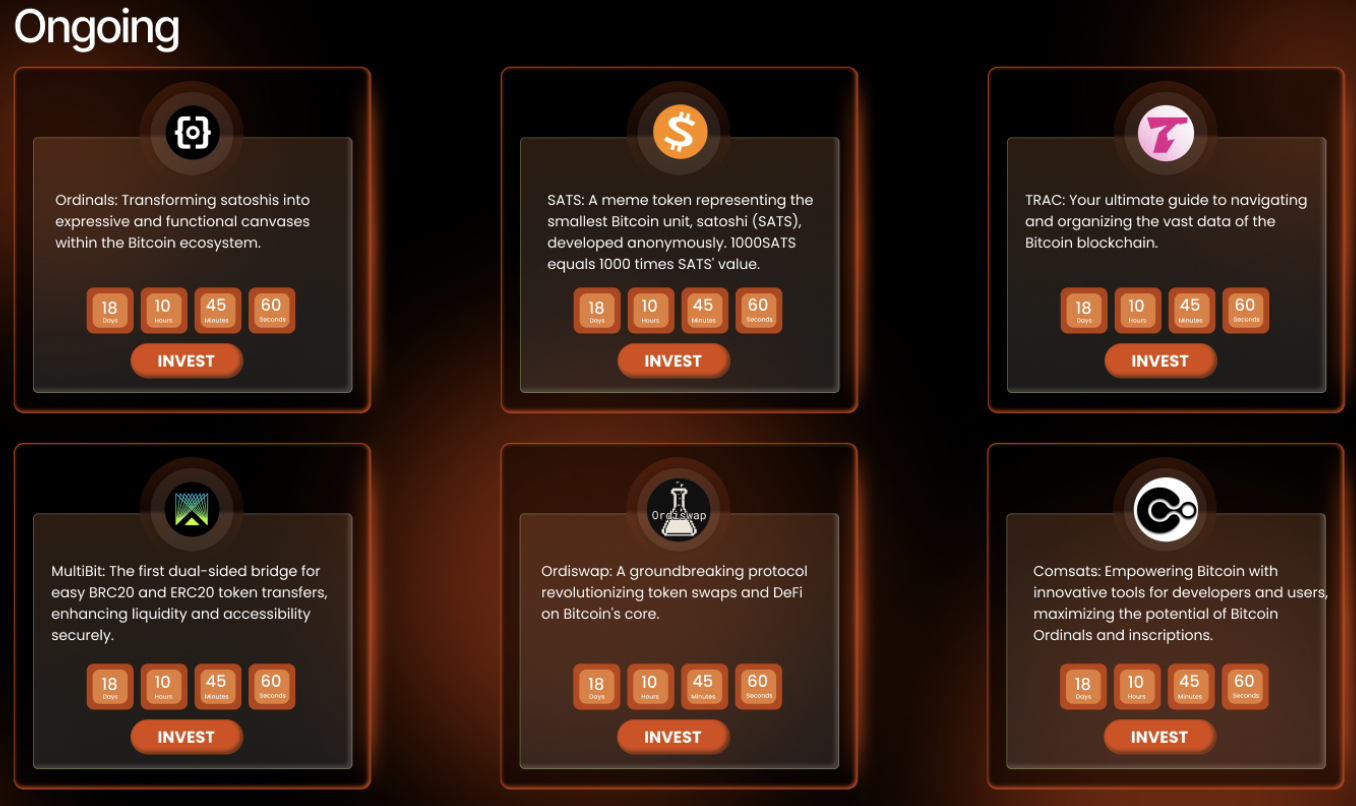

Launch Hub: OrangeDX's in-house

Launch Hub: OrangeDX's in-house

launchpad, dedicated to debuting innovative BRC 20 projects, thereby attracting organic traction from diverse project communities. The BRC-20 liquidity bootstrap combines a Launchpad, Initial Liquidity Offering (ILO), and Initial NFT Offering (INO) to bolster liquidity for new projects in the DeFi space. The Launchpad provides essential support for project development and market entry, while the ILO ensures stable liquidity by allocating funds to liquidity pools.

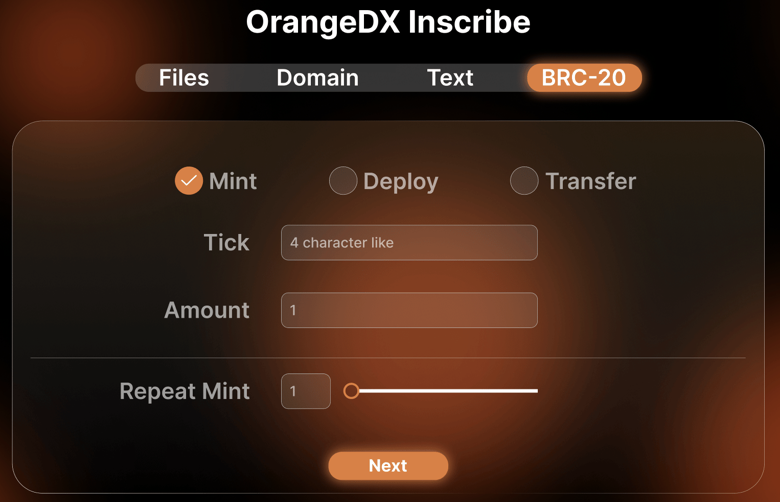

Inscription Tool: With OrangeDX's user-friendly inscription tool, users can make their imprint on the Bitcoin network forever. Construct enduring memorials, record life's milestones, or establish ownership of digital assets on the blockchain - all in a safe and intuitive setting.

Earn: Encompasses a suite of DeFi activities, including staking & restaking, yield farming, lending, and borrowing, offering users various avenues to generate yield on their crypto assets.

Roadmap

OrangeDX's roadmap outlines a comprehensive journey spanning from Q4 2023 to Q4 2024, showcasing a meticulous plan for the development and expansion of its platform. Initiatives include conceptualization, team formation, and initial platform development in Q4 2023, followed by the launch of the official website, platform testing, and partner onboarding in the first half of Q1 2024. The second half of Q1 2024 sees the public token sale, exchange listing, and launch of core functionalities like staking and the launchpad.

Subsequent quarters focus on enhancing platform features, facilitating fundraising for BRC-20 projects, expanding DEX capabilities, and building strategic partnerships. The roadmap also emphasizes the development of a DAO for community governance, security enhancements, and integration with additional BRC-20 DEXs, highlighting OrangeDX's commitment to continuous growth and innovation in the DeFi space.

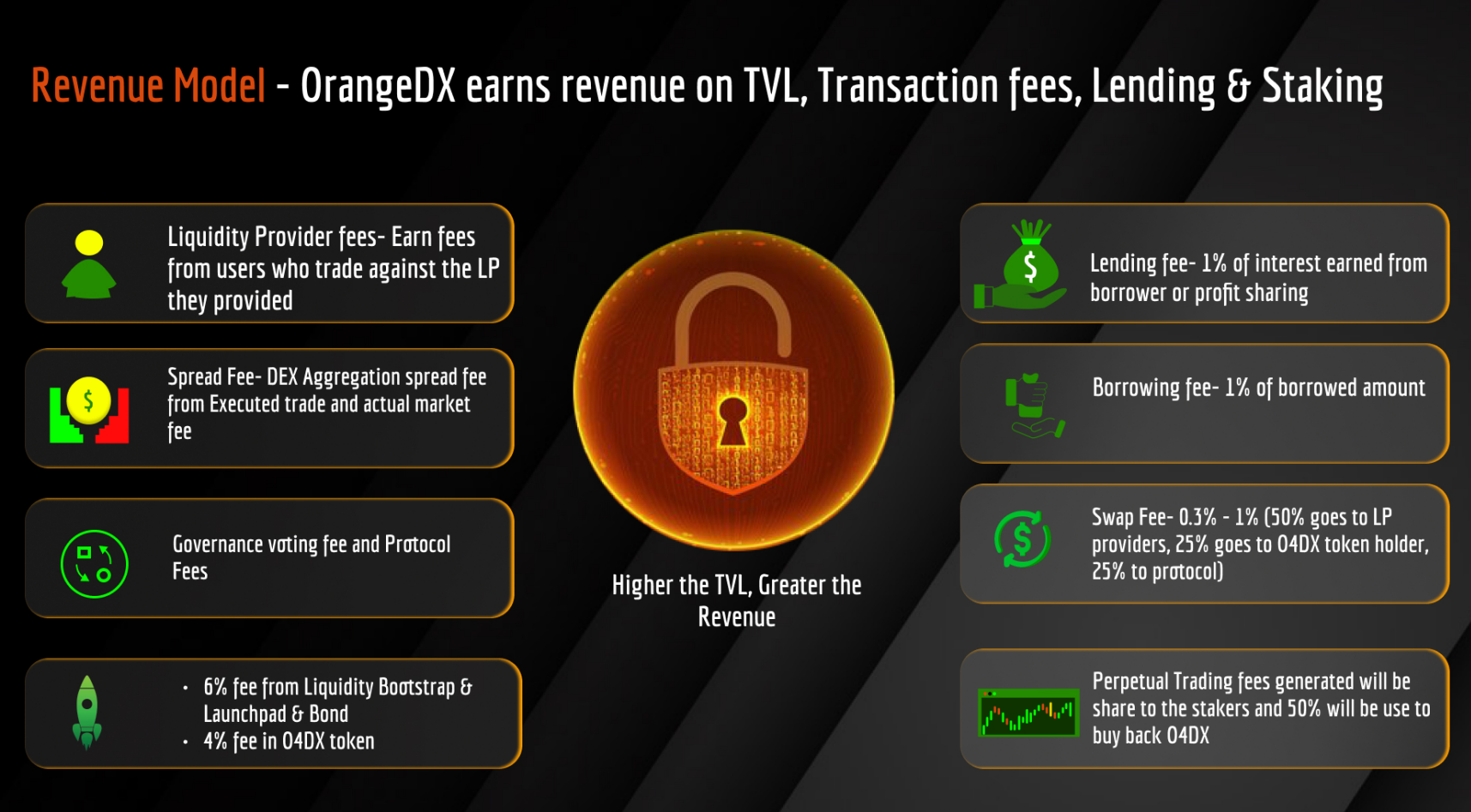

Revenue Streams

OrangeDX's revenue model stands out for its diversification, relying on multiple income streams. These include fees from liquidity provision, swap transactions, lending, borrowing, hosting IDOs, spread trading, perpetual trading, and cross-chain Bridge transactions.

Future avenues for revenue include potential ad placements, governance participation fees, protocol operation fees within a DAO framework, and offering white-label solutions. This multi-faceted approach ensures the sustainability and growth of OrangeDX's platform.

Tokenomics & Token Utilities

-

Token name: O4DX Token

-

Token Ticker: $O4DX

-

Token Standard: BRC-20

-

Network: Bitcoin

-

Total Supply: 100,000,000

-

Fully Diluted Valuation: $8,500,000

-

Initial Market Cap Without Liquidity: $2,885,750

-

Initial Market Cap: $2,375,750

Finceptor's investors will participate in the Public Round and Private Round. Public Round participants will have 100% of their tokens available at launch. Private Round participants will have a 35% discount to the Public round and will have 50% of their tokens available at launch.

Public Round Vesting Schedule: 100% unlocked at TGE.

Private Round Vesting Schedule: 50% unlocked at TGE, and the remaining 50% released after one month.

$O4DX plays a crucial role within the OrangeDX's DeFi Ecosystem, offering diverse functionalities:

-

Protocol Revenue Share: Contributing to platform liquidity pools, earning rewards from trading fees.

-

Utilizing Platform While Gaining Additional Rewards: Participation in staking and farming activities, providing opportunities for additional token rewards.

-

Bridging FeesÇ Utilization for covering bridging fees in the O4DX bridge, facilitating asset transfers between blockchain networks.

-

Participating in Launch Hub: Exclusive access to participate in token sales on the O4DX Launch Hub, with priority and special privileges during sales.

-

DAO Voting & Proposals: Governance rights, allowing token holders to vote on key decisions within the DAO. Participation in OrangeDX Improvement Proposals (OIP) for proposing and refining new ideas and improvements.

-

Discounts in the Ecosystem: Access to exclusive discounts across a range of OrangeDX products.

-

Buyback & Burn: Benefiting from a deflationary model with half of fees from decentralized exchange trades allocated for repurchase and burning of O4DX tokens. Additionally, the O4DX Vault and O4DX Smartpool systematically swaps a portion of revenue into O4DX tokens.

-

DAO Revenue Sharing: Sharing in OrangeDX's revenue through a revenue sharing model, with a portion of revenue allocated to the DAO treasury under community oversight for the active participation in DAO.

Marketing & User Acquisition Strategy

The go-to project marketing strategy is catered to focus on acquiring users via organic reach. The strategy will be a combination of Content (Viral Loop), Cross Community, and Engagement campaigns complemented by the vast network of KOLs and investors.

-

Cross Community marketing: All up for the growth of the ecosystem, there will be a lot of cross community activities and collaborations.

-

Engagement Campaigns: Multiple engagement campaigns ranging from beta testing, referrals, whitelisting, trading competitions, DAO selections, etc. All the campaigns will be tailored in an intricate way whereby the main focus and outcome will be to onboard users.

-

All of the contents and activities will be complemented by the vast network of KOLs. All KOLs will be strategically used to push contents and activities to their community.

Team

Investors & Partnerships

OrangeDX has prestigious group of backers, including Triple Gem Capital, Oddiyana Ventures, FAIRUM Ventures, NxGen, x21digital, alphabit fund, and Spice Capital. These renowned backers bring a wealth of experience and expertise in the cryptocurrency and blockchain space, supporting OrangeDX's mission to revolutionize DeFi by merging the stability of Bitcoin with the dynamic capabilities of decentralized finance.

OrangeDX boasts a diverse network of KOLs, including Coach K, Tasso, MMucko, as well as influencers from the CIS region, CryptoCup, Latin America, and over 150 smaller KOLs, strategically engaged to amplify brand presence and outreach.

Disclaimer

Before you consider participating in any investment opportunities on Finceptor, please take a moment to read and understand the following important information. Investing in cryptocurrencies, Web3 projects, and participating in token sales involve inherent risks you should be aware of.

Risk of Loss: Investing in cryptocurrencies and Web3 projects carries a significant risk of financial loss. Prices of tokens and cryptocurrencies can be extremely volatile and unpredictable. You could lose all or a substantial portion of your investment.

Research: You are responsible for conducting thorough research before participating in any investment opportunity. This includes understanding the project's purpose, technology, team, and market potential. Do not invest solely based on hype or promises.

Regulatory Considerations: Cryptocurrencies and Web3 projects are subject to various regulatory frameworks in different jurisdictions. Regulatory changes could impact the legality and functioning of projects. Ensure you understand the legal implications in your country or region.

Scams and Fraud: The cryptocurrency space has been associated with scams, fraudulent schemes, and phishing attacks. Be cautious of unsolicited offers, and always verify the authenticity of the information and individuals involved in a project.

Unpredictable Technology: Web3 projects use new and advanced tech that might not be fully checked. This could lead to problems and money loss.

Liquidity Risks: Tokens acquired through pre-sales or investments may not have an active secondary market initially, which could limit your ability to buy, sell, or trade them.

Financial Advice: The information provided on our platform, including whitepapers, project details, and investment recommendations, should not be considered financial advice. You should consult with a qualified financial advisor before making any investment decisions.

You acknowledge and accept these risks by accessing and using Finceptor's investment platform. You agree to conduct due diligence and make investment decisions based on your own judgment. Finceptor does not assume any responsibility for your investment choices or the outcomes thereof.

Please remember that investing in cryptocurrencies and Web3 projects can be speculative and involves high risk. Only invest what you can afford to lose.

This disclaimer is designed to inform potential investors about the risks and considerations associated with participating in the Finceptor investment platform. However, it is advised to consult legal experts to ensure the disclaimer is appropriate for your specific circumstances and legal requirements.

Purchasing, holding, and transacting in any way with tokens shall not warrant, commit nor guarantee any revenue, profit, or value appreciation. Purchasing tokens shall not be construed as an investment. Token merely offers utilities and features within the project's ecosystem and platforms. Finceptor reserves its right to amend and modify the utilities and features offered by the project.

Crypto and crypto assets transactions, including tokens, are very risky regarding potential losses, merchantability, technical failures, and legal and tax requirements. Indeed, the price of crypto assets can even become zero or be excessively volatile. By purchasing and holding or transacting in any way with the token, you agree and acknowledge that you undertake such risks on your own and shall consult your legal and tax consultants for compliance purposes.

We do not provide investment or financial advice, and all projects reviewed are done objectively in accordance with established reporting and information dissemination best practices. Before investing in any Web3-related project, you should conduct your research. As a result, Finceptor is not liable for any losses incurred due to a consumer's investment decision.