A leveraged farming and trading protocol that offers the highest APYs.

Registration Period

Guaranteed Allocation Round

Increase your allocation by staking more $FINC for longer.

First-Come-First-Serve Round

Proportional to guaranteed allocation.

Vesting Period

Deal Size

$160,000.00

Price

$0.04

1 PMX = $0.04

Loading...

Balance

Loading...

Invested

Loading...

Remaining Allocation

Loading...

Sale Metrics

Token Metrics

Table of Contents

- Introducing Primex Finance

- Highlights

- Features & Products

- Roadmap

- Revenue Streams

- Tokenomics & Token Utilities

- Marketing & User Acquisition Strategy

- Team

- Investors & Partnerships

- Disclaimer

Introducing Primex Finance

Primex Finance is a cutting-edge leveraged farming and trading protocol that delivers the highest APYs in the market. It allows users to margin trade an unlimited range of tokens on DEXs. By leveraging lender liquidity, borrowers can engage in low-risk investments such as liquid staking tokens, liquid restaking tokens, real-world assets, and DEX liquidity provider positions. Additionally, users can margin trade assets on spot DEXs, including those unavailable on centralized exchanges.

The protocol provides numerous benefits to its users. There are no minimum amount requirements for lenders and farmers, enabling anyone to participate. With zero interface swap fees and automated limit swaps, Primex simplifies trading. It also supports an unlimited number of tokens for leverage, including unique assets like memecoins and AI-based tokens not listed on CEXs. Furthermore, it offers advanced position management tools, such as Take-Profit and Stop-Loss functionalities, on DEXs. Lenders can earn passive yields, and participants can access the Primex Rewards program for additional incentives.

Primex Finance empowers users to explore high-APY strategies, unlock unique trading opportunities, and fully embrace the potential of decentralized finance.

Highlights

- Already over $350,000 in total value locked (TVL).

- Backed by CoinFund, Wintermute, Morningstar Ventures, GSR, Mapleblock Capital, and others, raising over $6.6 million in funding.

- A vibrant community of more than 150,000 members across various social platforms.

- Launching on leading IDO platforms.

- Received Uniswap-Arbitrum and Arbitrum LTIPP grants.

- Achieved 700–800 monthly active users (MAUs), 6,000 total users, and 65,000 unique wallets during the testnet phase.

Features & Products

-

Leveraged Yield Farming: Maximize returns by leveraging low-risk assets such as liquid staking tokens, liquid restaking tokens, real-world assets, and DEX liquidity provider positions.

-

Margin Trading on DEXs: Engage in margin trading across a wide range of tokens on integrated DEXs like Uniswap, Balancer, and Curve, including assets not available on CEX.

-

Advanced Trading Tools: Utilize features such as automated limit orders, Take-Profit and Stop-Loss functionalities, and custom slippage tolerance to execute sophisticated trading strategies.

-

Cross-DEX Trading with Aggregation: Access multiple DEXs through Primex’s integration, enabling optimal swap routes and minimized trading fees via the Primex Router.

-

Decentralized Trade Execution: Experience fully decentralized trade execution managed by a network of community-hosted bots called Keepers, ensuring transparency and eliminating the need for intermediaries.

-

Credit Buckets for Lenders: Lend digital assets through Primex’s Credit Buckets, each with specific trading rules and risk profiles, allowing for diversified lending portfolios and high APYs backed by margin trading fees.

-

AI-Powered Portfolio Management: In upcoming versions, manage a cross-margin portfolio encompassing positions in liquid staking, restaking, RWAs, and DEX LP tokens, all under a unified health factor with AI-driven rebalancing for yield optimization.

Roadmap

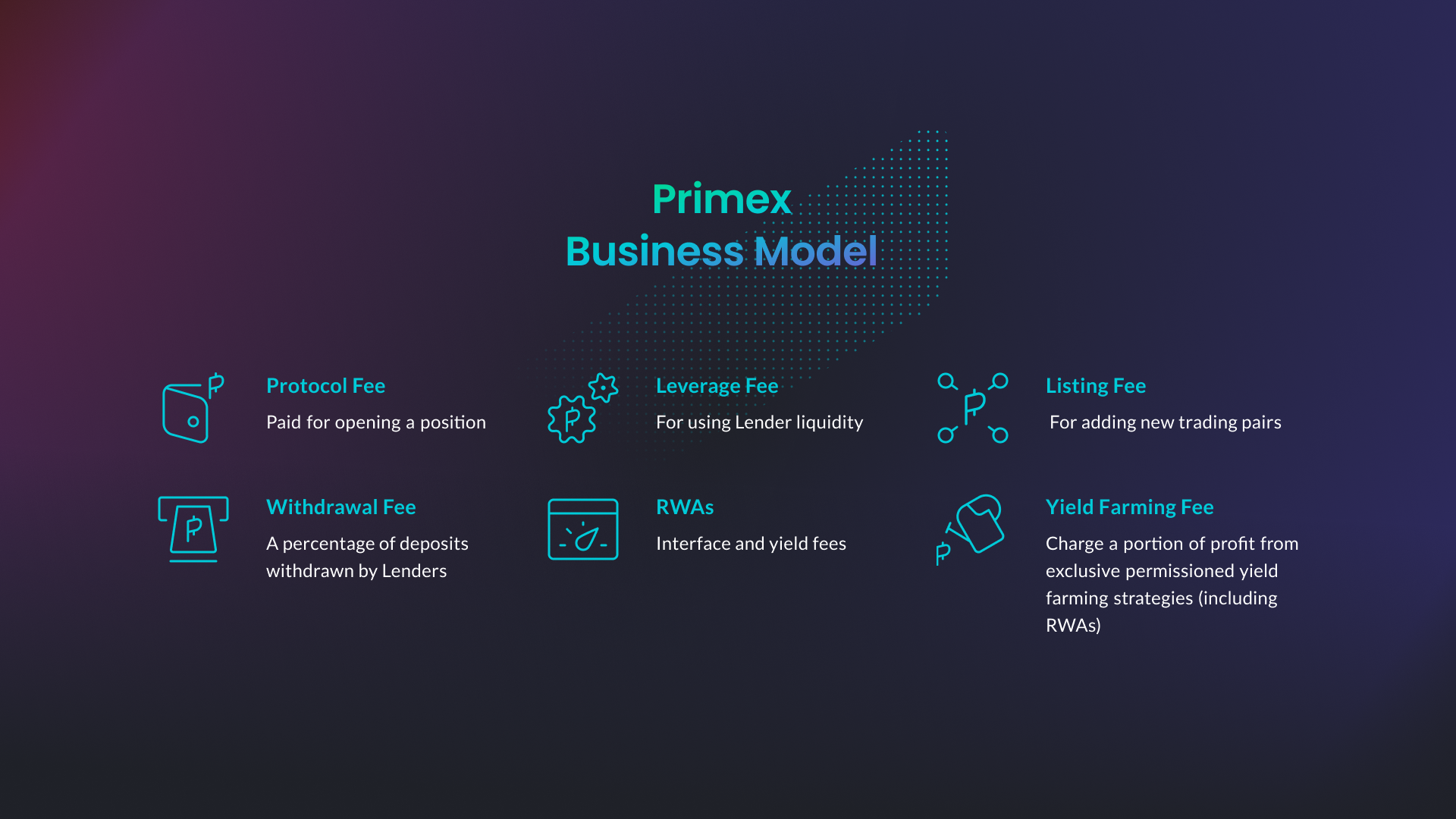

Revenue Streams

Tokenomics & Token Utilities

- Token Ticker: $PMX

- Token Standard: ERC-20

- Network: Base

- Total Supply: 1,000,000,000

- Fully Diluted Valuation: $40,000,000

- Initial Market Cap Without Liquidity: $2.237.531

- Initial Market Cap: $6.436.864

Finceptor’s investors will participate in the Public Round and will have 25% of their tokens available at launch.

Marketing & User Acquisition Strategy

Primex Finance employs a multifaceted marketing and user acquisition strategy to establish itself as a leading platform in the DeFi ecosystem. One of its primary approaches is incentivizing user participation through a liquidity mining program. The protocol has allocated 30,000,000 PMX tokens to reward users for on-chain activities, fostering engagement and attracting new participants. This is complemented by a revamped referral program that encourages existing users to invite others by offering a share of protocol commissions as rewards.

Strategic partnerships and integrations also play a significant role in Primex’s growth strategy. By collaborating with other DeFi platforms and integrating with various DEXs, Primex broadens its ecosystem and enhances its service offerings. The platform also emphasizes a community-driven approach, with decentralized trade execution managed by a network of community-hosted bots. This fosters a sense of ownership and active participation among its users.

To educate and attract informed users, Primex focuses on creating high-quality educational content and outreach initiatives. Through Medium articles, documentation, and other resources, the platform informs potential users about its features, benefits, and the broader DeFi landscape. Trust-building is another critical aspect of its strategy, with Primex undergoing comprehensive security audits by reputable firms such as Halborn and Quantstamp to ensure platform safety and reliability.

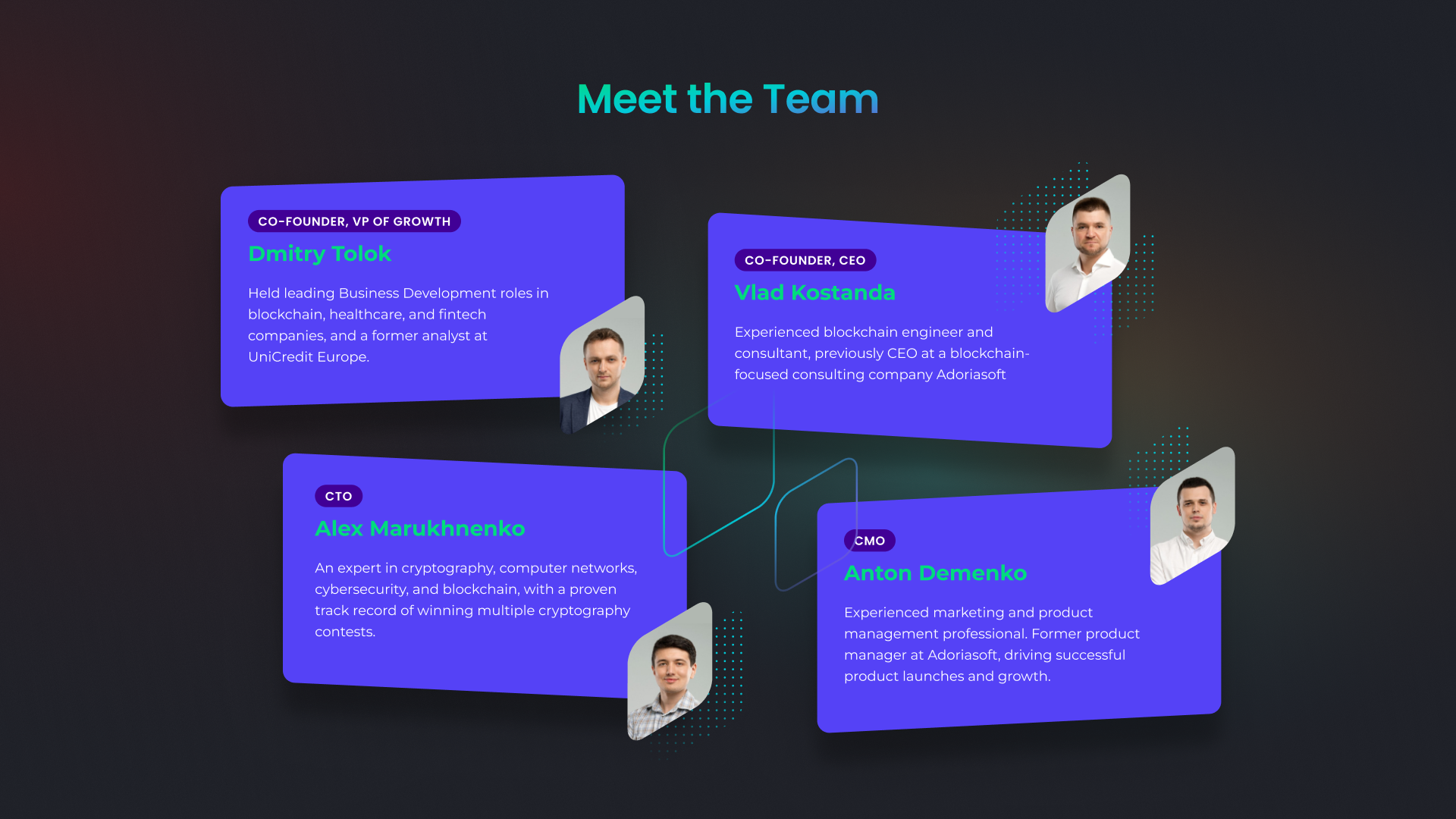

Team

Investors & Partnerships

Disclaimer

Before you consider participating in any investment opportunities on Finceptor, please take a moment to read and understand the following important information. Investing in cryptocurrencies, Web3 projects, and participating in token sales involve inherent risks you should be aware of.

Risk of Loss: Investing in cryptocurrencies and Web3 projects carries a significant risk of financial loss. Prices of tokens and cryptocurrencies can be extremely volatile and unpredictable. You could lose all or a substantial portion of your investment.

Research: You are responsible for conducting thorough research before participating in any investment opportunity. This includes understanding the project's purpose, technology, team, and market potential. Do not invest solely based on hype or promises.

Regulatory Considerations: Cryptocurrencies and Web3 projects are subject to various regulatory frameworks in different jurisdictions. Regulatory changes could impact the legality and functioning of projects. Ensure you understand the legal implications in your country or region.

Scams and Fraud: The cryptocurrency space has been associated with scams, fraudulent schemes, and phishing attacks. Be cautious of unsolicited offers, and always verify the authenticity of the information and individuals involved in a project.

Unpredictable Technology: Web3 projects use new and advanced tech that might not be fully checked. This could lead to problems and money loss.

Liquidity Risks: Tokens acquired through pre-sales or investments may not have an active secondary market initially, which could limit your ability to buy, sell, or trade them.

Financial Advice: The information provided on our platform, including whitepapers, project details, and investment recommendations, should not be considered financial advice. You should consult with a qualified financial advisor before making any investment decisions.

You acknowledge and accept these risks by accessing and using Finceptor's investment platform. You agree to conduct due diligence and make investment decisions based on your own judgment. Finceptor does not assume any responsibility for your investment choices or the outcomes thereof.

Please remember that investing in cryptocurrencies and Web3 projects can be speculative and involves high risk. Only invest what you can afford to lose.

This disclaimer is designed to inform potential investors about the risks and considerations associated with participating in the Finceptor investment platform. However, it is advised to consult legal experts to ensure the disclaimer is appropriate for your specific circumstances and legal requirements.

Purchasing, holding, and transacting in any way with tokens shall not warrant, commit nor guarantee any revenue, profit, or value appreciation. Purchasing tokens shall not be construed as an investment. Token merely offers utilities and features within the project’s ecosystem and platforms. Finceptor reserves its right to amend and modify the utilities and features offered by the project.

Crypto and crypto assets transactions, including tokens, are very risky regarding potential losses, merchantability, technical failures, and legal and tax requirements. Indeed, the price of crypto assets can even become zero or be excessively volatile. By purchasing and holding or transacting in any way with the token, you agree and acknowledge that you undertake such risks on your own and shall consult your legal and tax consultants for compliance purposes.

We do not provide investment or financial advice, and all projects reviewed are done objectively in accordance with established reporting and information dissemination best practices. Before investing in any Web3-related project, you should conduct your research. As a result, Finceptor is not liable for any losses incurred due to a consumer’s investment decision.