Yield, volatility, and points trading marketplace for any asset.

Registration Period

Guaranteed Allocation Round

Increase your allocation by staking more $FINC for longer.

First-Come-First-Serve Round

Proportional to guaranteed allocation.

Vesting Period

Deal Size

$250,000.00

Price

$0.20

1 JACK = $0.20

Loading...

Balance

Loading...

Invested

Loading...

Remaining Allocation

Loading...

Sale Metrics

Token Metrics

Table of Contents

- Introducing Stable Jack

- Highlights

- Features & Products

- Roadmap

- Revenue Streams

- Tokenomics & Token Utilities

- Go-to-Market & User Acquisition Strategy

- Team

- Investors & Partnerships

- Disclaimer

Introducing Stable Jack

Stable Jack is a DeFi platform that transforms yield, volatility, and points markets by splitting the yield and volatility of collateral assets into two distinct tokens: Yield Tokens and Volatility Tokens. This mechanism enables fixed and leveraged yield on stablecoins, LSTs, and LRTs, leveraged airdrop and points farming, and leveraged long positions without liquidation risk. By addressing key DeFi pain points—such as unpredictable yields, limited volatility trading options, and inefficient points farming—Stable Jack provides innovative financial products that enhance user returns while preserving principal.

Highlights

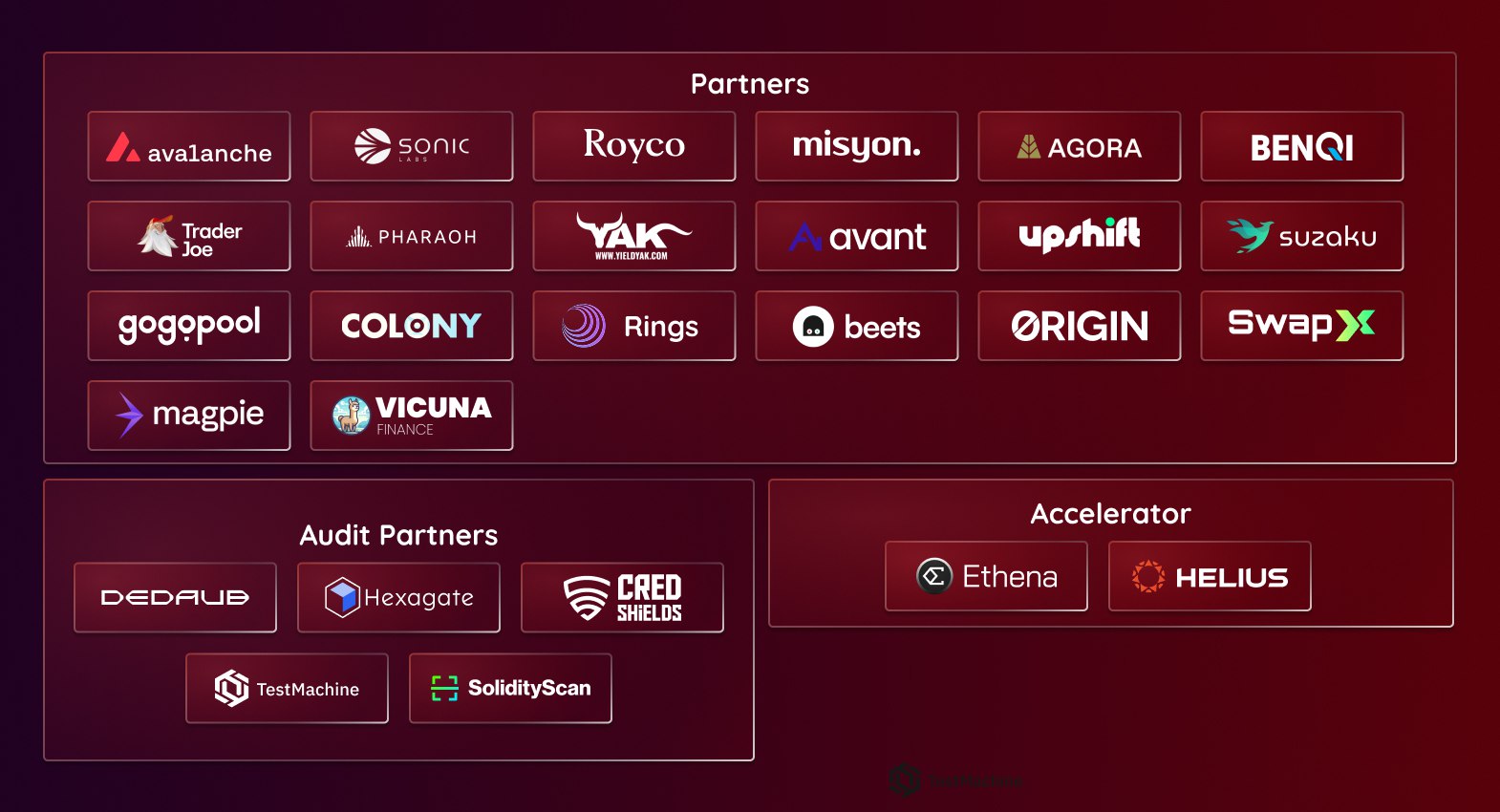

- Accelerated by Ethena Labs and Helius Labs!

- A profitable protocol with a 70% retention rate and 33% monthly growth rate, demonstrating strong product-market fit!

- Partnerships with major names such as Avalanche, Sonic, Royco, Rings Protocol, BENQI, Agora, and more!

- $5 million in Total Value Locked with over 3,500 users onboarded!

- Audited and secured by Hexagate, CredShields, SolidityScan, TestMachine AI, and Dedaub!

- A thriving community of over 200,000 members across various social media platforms!

Features & Products

-

Fixed Yield on Stablecoins: Users can earn predictable, stable returns on their holdings through Stable Jack’s structured yield markets, ensuring reliable passive income.

-

Leveraged Yield on Stablecoins, LSTs & LRTs: Through Stable Jack’s composable collateral system, users can amplify their yield exposure without facing traditional liquidation risks.

-

Volatility Tokens: Designed for users who want to hedge against price fluctuations or speculate on volatility. These tokens provide exposure to market movements without directly holding the underlying assets.

-

Principal Protection: Retain exposure to underlying assets while farming points/yields.

-

Points & Airdrop Farming: Stable Jack enables users to leverage positions to maximize potential earnings from airdrop programs and points-based incentive mechanisms within DeFi ecosystems.

-

Composable Collateral & RWA Integration: Accepting a broad range of assets, including LSTs, LRTs, and tokenized RWAs, Stable Jack allows for more diverse and flexible collateralization strategies.

-

Points Trading: Stable Jack v2 will enable investors to access leveraged points exposure without risking their principal. This model is similar to Pendle’s points trading.

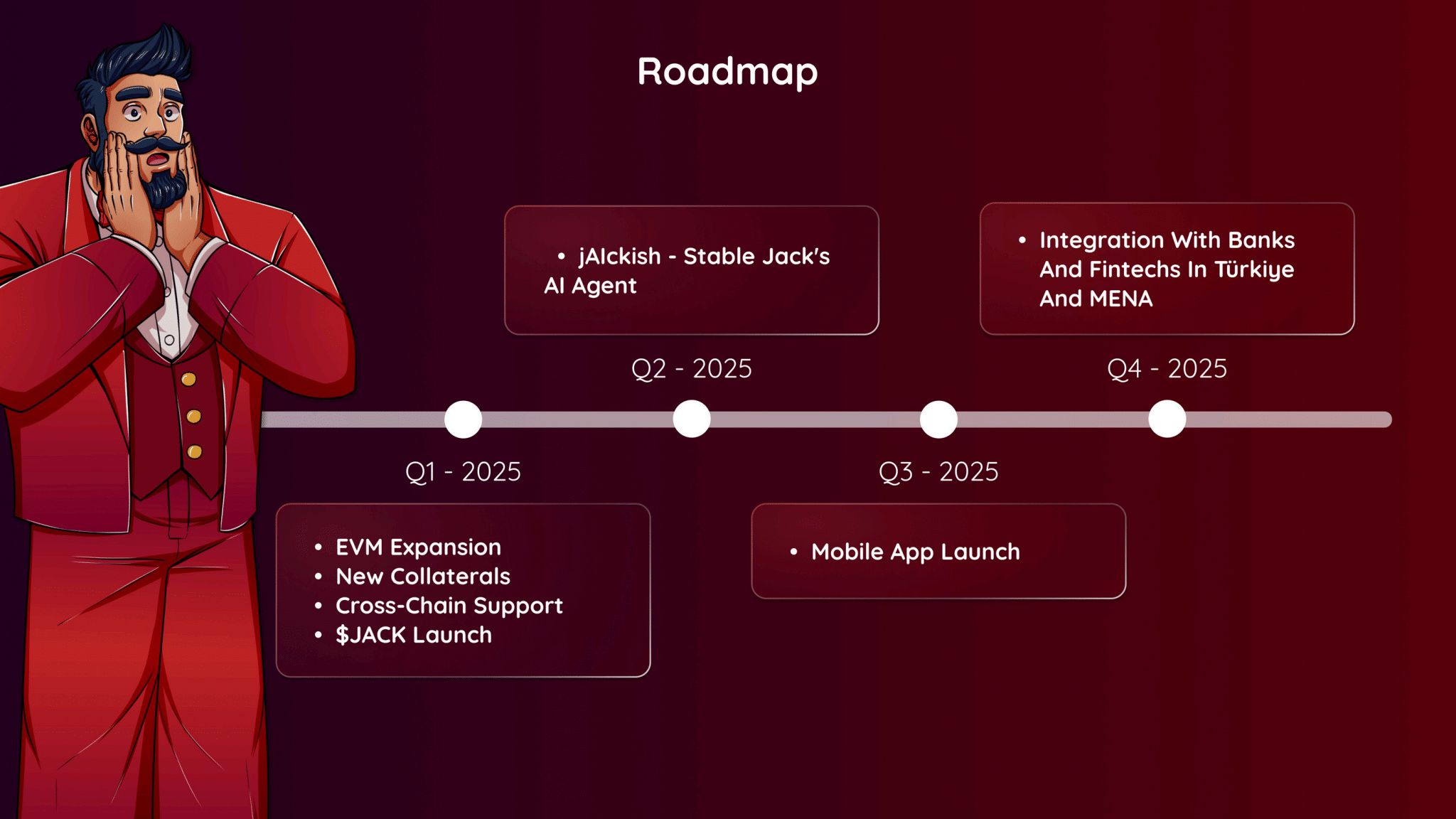

Roadmap

Revenue Streams

-

Minting & Redemption Fees: Charges applied when users mint or redeem assets.

-

Yield Commission: A share of the yield generated from the collateral asset.

-

Management Fee: Collected from the Volatility token.

Tokenomics & Token Utilities

- Token Ticker: JACK

- Token Standard: ERC-20

- Network: Avalanche

- Total Supply: 100,000,000

- Fully Diluted Valuation: $20,000,000

- Initial Market Cap Without Liquidity: $4,576,600

- Initial Market Cap: $5,344,000

Finceptor’s investors will participate in the Public Round and will have 100% of their tokens available at launch. $JACK will have various utilities in the Stable Jack ecosystem

-

Revenue Sharing: As the protocol matures and grows, Stable Jack will allow revenue sharing for $sJACK holders.

-

Fee Rebate: $sJACK holders are going to be eligible for fee rebates while minting/redeeming the VT/YT. This will depend on how much $sJACK they hold.

-

Governance: $sJACK holders will be eligible to vote on the decisions of the Community Collective, which is the branch of our protocol that deals with community activities, marketing, and campaigns.

-

Discount for JACK: Assuming other requirements for Option Liquidity Mining Rewards are met, $sJACK holders will be eligible to buy $JACK tokens with an additional discount. The discount for the $sJACK holders will be based on the amount and the time period they stake.

Go-to-Market & User Acquisition Strategy

Stable Jack partners with LST/LRT protocols, yield-bearing stablecoin issuers, perpetual protocols, RWA issuers, lending markets, and DEXs to accept their assets as collateral. This expands its reach, attracts new communities organically, and drives liquidity while offering yield and derivative products.

Team

Investors & Partnerships

Disclaimer

Before you consider participating in any investment opportunities on Finceptor, please take a moment to read and understand the following important information. Investing in cryptocurrencies, Web3 projects, and participating in token sales involve inherent risks you should be aware of.

Risk of Loss: Investing in cryptocurrencies and Web3 projects carries a significant risk of financial loss. Prices of tokens and cryptocurrencies can be extremely volatile and unpredictable. You could lose all or a substantial portion of your investment.

Research: You are responsible for conducting thorough research before participating in any investment opportunity. This includes understanding the project's purpose, technology, team, and market potential. Do not invest solely based on hype or promises.

Regulatory Considerations: Cryptocurrencies and Web3 projects are subject to various regulatory frameworks in different jurisdictions. Regulatory changes could impact the legality and functioning of projects. Ensure you understand the legal implications in your country or region.

Scams and Fraud: The cryptocurrency space has been associated with scams, fraudulent schemes, and phishing attacks. Be cautious of unsolicited offers, and always verify the authenticity of the information and individuals involved in a project.

Unpredictable Technology: Web3 projects use new and advanced tech that might not be fully checked. This could lead to problems and money loss.

Liquidity Risks: Tokens acquired through pre-sales or investments may not have an active secondary market initially, which could limit your ability to buy, sell, or trade them.

Financial Advice: The information provided on our platform, including whitepapers, project details, and investment recommendations, should not be considered financial advice. You should consult with a qualified financial advisor before making any investment decisions.

You acknowledge and accept these risks by accessing and using Finceptor's investment platform. You agree to conduct due diligence and make investment decisions based on your own judgment. Finceptor does not assume any responsibility for your investment choices or the outcomes thereof.

Please remember that investing in cryptocurrencies and Web3 projects can be speculative and involves high risk. Only invest what you can afford to lose.

This disclaimer is designed to inform potential investors about the risks and considerations associated with participating in the Finceptor investment platform. However, it is advised to consult legal experts to ensure the disclaimer is appropriate for your specific circumstances and legal requirements.

Purchasing, holding, and transacting in any way with tokens shall not warrant, commit nor guarantee any revenue, profit, or value appreciation. Purchasing tokens shall not be construed as an investment. Token merely offers utilities and features within the project’s ecosystem and platforms. Finceptor reserves its right to amend and modify the utilities and features offered by the project.

Crypto and crypto assets transactions, including tokens, are very risky regarding potential losses, merchantability, technical failures, and legal and tax requirements. Indeed, the price of crypto assets can even become zero or be excessively volatile. By purchasing and holding or transacting in any way with the token, you agree and acknowledge that you undertake such risks on your own and shall consult your legal and tax consultants for compliance purposes.

We do not provide investment or financial advice, and all projects reviewed are done objectively in accordance with established reporting and information dissemination best practices. Before investing in any Web3-related project, you should conduct your research. As a result, Finceptor is not liable for any losses incurred due to a consumer’s investment decision.