Trakx is a regulated platform offering thematic Crypto Tradable Indices and strategies.

Registration Period

Guaranteed Allocation Round

Increase your allocation by staking more $FINC for longer.

First-Come-First-Serve Round

Proportional to guaranteed allocation.

Vesting Period

Deal Size

$150,000.00

Price

$0.025

1 TRKX = $0.025

Loading...

Balance

Loading...

Invested

Loading...

Remaining Allocation

Loading...

Sale Metrics

Token Metrics

Table of Contents

- Introducing Trakx

- Highlights

- Features & Products

- Roadmap

- Revenue Streams

- Tokenomics & Token Utilities

- Marketing & User Acquisition Strategy

- Team

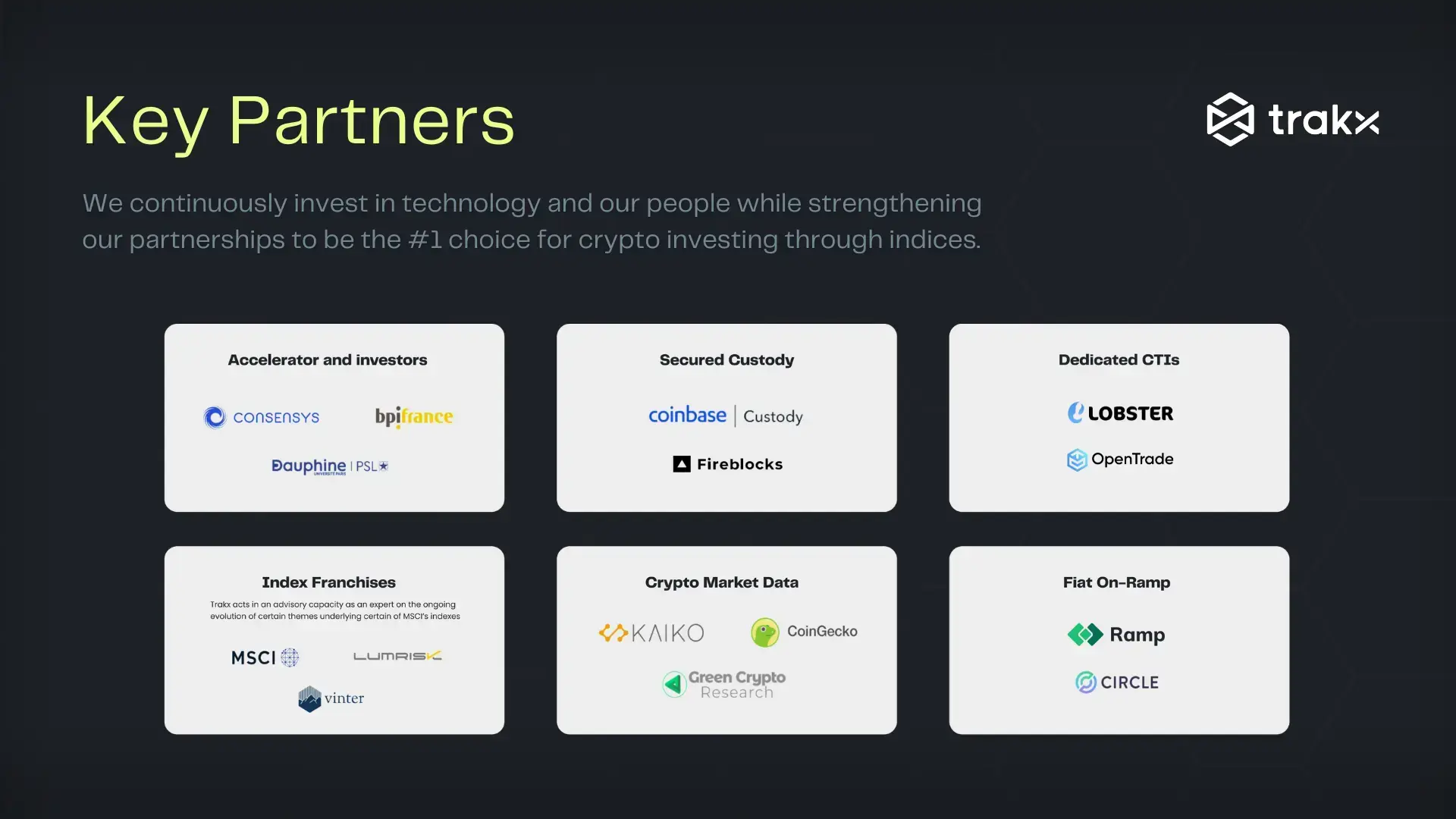

- Investors & Partnerships

- Disclaimer

Introducing Trakx

Trakx is a regulated platform for crypto-index trading, offering thematic Crypto Tradable Indices (CTIs) and a variety of smart investment strategies. Designed for both institutional and retail investors, Trakx provides convenient access to diversified crypto investments, with automatic rebalancing, risk management, and compliance as core features. The platform simplifies investing in crypto by offering easy-to-access, risk-profiled products, including staked indices, while maintaining a focus on making institutional-grade strategies available to a broader audience in a safe and compliant manner.

Trakx stands out for its experienced team of experts from institutional finance, fintech, and crypto markets, ensuring a deep understanding of the financial landscape. As a registered Virtual Asset Service Provider (VASP) with French regulators AMF and ACPR, Trakx is committed to regulatory compliance and building trust. The platform leverages proprietary technology to deliver innovative, efficient, and adaptable crypto asset indices. Trakx prioritizes risk management by avoiding lending, derivatives, or leverage, and secures assets with leading custodians like Fireblocks and Coinbase Custody, providing end-to-end control and a safe investment environment.

Highlights

-

From the Consensys’ Tachyon Accelerator Program 2020 Cohort.

-

Exchange is live with 24 indices and strategies structured in-house serving 10,000 KYC'ed traders with a mix of retail and semi-institutional traders.

-

Registered as Virtual Asset Service Provider (VASP) with French regulators AMF and ACPR.

-

An experienced team in investment analysis, financial management, tax analysis, equity research, and other finance and economics areas, spanning both the Web2 and Web3 industries, with backgrounds in reputable companies.

-

Launching on top IDO platforms & CEXs in the web3 space.

-

Successfully raised $3 million in equity from ConsenSys and +20 angel investors, along with $3.4 million through a private token sale.

-

Strategic partnerships with tier one companies (Enigma, Makor, MSCI, Vinter, Market Securities, Calci , Purple Capital...)

-

Over 125,000 community members across various social media platforms.

Features & Products

- Thematic Indices

-

Trakx Bitcoin/Ether (50/50): Tracks performance of Bitcoin and Ether, representing over 50% of the total crypto market.

-

Trakx Top 10 Crypto: Replicates the performance of the top 10 digital assets, covering 85% of the market, weighted by market cap.

-

Trakx Centralised Exchanges: Tracks tokens of the largest centralised exchanges, reflecting the adoption of CEX platforms.

-

Trakx Top 10 DeFi: Replicates top 10 decentralized finance protocol tokens, capturing blockchain-based finance growth.

-

Trakx Decentralised Exchanges: Tracks largest DEX tokens, reflecting growth in blockchain trading activity.

-

Trakx Lending: Replicates performance of top lending/borrowing protocol tokens, capturing crypto lending growth.

-

Trakx Top 10 Proof-of-Stake: Tracks the top 10 PoS assets, showcasing ESG-compliant blockchain growth.

-

Trakx Top Blockchains: Replicates top smart contract platform tokens, reflecting innovation and decentralisation.

-

Trakx NFT Metaverse: Tracks leading metaverse and NFT tokens, disrupting gaming, entertainment, and art.

-

Trakx Interoperability: Tracks tokens enabling blockchain interoperability, vital for a multi-chain world.

-

Trakx ESG: Replicates top-rated assets in environmental, social, and governance criteria.

-

Trakx DePIN: Tracks tokens of decentralized physical infrastructure networks (DePIN) across sectors like transport and energy.

-

Trakx Real World Assets: Replicates tokens linked to real-world assets (RWA), weighted equally based on market factors.

-

Trakx Artificial Intelligence: Tracks AI-related cryptocurrencies, rebalanced monthly based on market data.

-

Trakx Gaming: Tracks the top 10 gaming cryptocurrencies, equally weighted.

- Smart Investing (Rule-based):

-

Trakx Bitcoin Control 15: Offers exposure to Bitcoin with controlled volatility, targeting around 15%.

-

Trakx Digital Inflation Hedge: Hedges inflation via Pax Gold and dynamic Bitcoin exposure.

-

Trakx Recovery: Tracks tokens with significant price drops but strong on-chain financials.

-

Trakx Bitcoin Momentum: Risk-managed exposure to Bitcoin, identifying trends and trading long positions.

- Risk-Profiled:

-

Trakx Conservative: Focuses on safer assets, with stablecoins, Bitcoin, and Ethereum making up 75% of the portfolio.

-

Trakx Balanced: Combines stablecoins, Bitcoin, Ethereum (50% exposure) with diversified blockchain assets.

-

Trakx Growth: Higher-risk basket driven by Trakx Top Blockchains CTI (75% exposure) for broader market upside.

- Staked/Earn:

-

Staked Matic: Replicates Matic’s performance with added staking rewards.

-

USDc Earn: Enables earning T-Bill-like returns on USDc, managed securely via OpenTrade. (Coming soon)

Roadmap

2024

-

Prepare the transition to MiCA - Strategize and implement measures to ensure compliance with the Markets in Crypto-Assets (MiCA) regulations for seamless transition.

-

Launch of more sophisticated products for sophisticated traders.

-

Push on bespoke solutions - deployment of tailor-made solutions to address specific client requirements.

-

Develop tech-as-a-service offering - Create a comprehensive technology-as-a-service offering to provide clients with customizable white label tech solutions.

-

Expand geographic footprint outside Europe - Explore opportunities for market expansion and establish presence in new geographical regions beyond Europe.

-

Fine-tuning of the data mining and trading bots - Continuously optimize and refine algorithms and parameters of data mining and trading bots for improved performance and efficiency.

-

Mobile app - Develop and launch a mobile application to extend accessibility and convenience for users accessing the platform on mobile devices.

-

Dashboard for influencers - Develop a specialized dashboard tailored for influencers. Yield staking CTIs (similar to Staked Matic) - Implement yield staking mechanisms for CTIs akin to the Staked Matic model, to encourage token holder engagement.

-

Allow listing some products only to selected user groups - Enable the feature to restrict product listings to specific user groups, enhancing targeted marketing and exclusivity.

-

USDc Earn CTI - Develop a new CTI that generates yields from t-bills.

-

Ability to let customers stake POS assets - Introduce the capability for customers to stake Proof-of-Stake (POS) assets.

-

Create a notification center on the WebApp - Implement a centralized notification system within the WebApp to keep users informed about relevant updates and events.

-

Add translations to the website and app - Expand accessibility by incorporating multilingual support for the website and application, catering to diverse user demographics.

-

Obtain SOC2 Type 2 or ISO27001 Certification - Pursue industry-standard certifications to ensure compliance with security and data protection protocols, fostering trust and credibility.

-

Build a mobile trading app - Develop a dedicated mobile application for trading activities, offering convenience and flexibility to retail users.

-

Use Fireblocks as (Custodial) hot wallet - Integrate Fireblocks as a custodial hot wallet solution to enhance the security and management of digital assets.

-

Offer DCA strategy (small regular investments) - Implement Dollar-Cost Averaging (DCA) strategy functionality to enable users to invest small amounts regularly, promoting long-term investment habits.

-

Add some gamification principles in the Exchange - Incorporate gamification elements into the exchange platform to enhance user engagement and retention through interactive features.

2025

-

Allow redemption in kind - Explore the implementation of redemption options in kind, providing users with alternative methods to redeem assets.

-

Use ZK Proofs for Proof of Fundings - Investigate the utilization of Zero-Knowledge Proofs (ZK Proofs) for verifying Proof of Fundings, enhancing privacy and security.

-

Conversational UI - Develop a conversational user interface (UI) to streamline user interactions and enhance user experience through natural language processing capabilities.

-

Yield offer on USDc / see USDc earn CTI- Explore opportunities to offer yield incentives on USD Coin (USDC) or leverage the Yield Treasury CTIs to optimize yield generation strategies.

-

On Ramp solution - Implement an on-ramp solution to simplify the process of converting fiat currency to cryptocurrency, facilitating user onboarding and adoption.

-

Fireblock Non Custodial Wallet - Develop a non-custodial wallet solution leveraging Fireblocks technology to provide users with enhanced control over their digital assets.

Revenue Streams

-

Maker Fees: Charged to users who provide liquidity to the market by placing limit orders that don't get immediately filled.

-

Taker Fees: Charged to users who take liquidity from the market by placing market orders or executing against existing orders.

-

Management Fees: Charged based on the complexity of the product. Ranges from 1% to 2% annually, based on the product's structuring complexity. Management fees provide a more stable and predictable income stream compared to trading fees. They are not directly tied to market volatility, providing a balance in revenue generation.

-

SaaS Fees for White-Label Solutions: We provide white-label solutions to other entities such as exchanges, brokers, and neo-banks and charge Software as a Service (SaaS) fees for the use of our technology and infrastructure.

Tokenomics & Token Utilities

-

Token Ticker: TRKX

-

Token Standard: ERC-20

-

Network: Polygon

-

Total Supply: 1,000,000,000

-

Fully Diluted Valuation: $25,000,000

-

Initial Market Cap Without Liquidity: $300,000

Finceptor’s investors will participate in the Public Round and will have 20% of their tokens available at launch.

The Trakx token, TRKX, is a key tool to grow the Trakx retail ecosystem. It will provide its users with access to a wide range of advantages and benefits, including:

-

Discount programs: Up to 50% discount on trading fees, depending upon the amount of TRKX tokens staked.

-

Referral programs boosters: From 20% to 35% fees redistributed for referrals, depending upon the amount of TRKX tokens staked.

-

Grant programs: Active community members will receive grants in TRKX tokens in exchange for specific actions & services (e.g. deposits and/or CTI purchases, trading competition…)

-

Governance: TRAKX community will get the opportunity to play an important role in key decisions, such as grant programs.

-

Buyback and burn programs: 20% of the revenues derived from the retail trading business will be put in a vault and discretionarily used to buyback the TRKX tokens.

-

Higher API trading rate

-

Other perks: Priority access to new products (ie. alpha and bespoke products) & dedicated services (white glove, managed accounts…)

Marketing & User Acquisition Strategy

Trakx has cultivated an active social media presence across platforms such as X, Telegram, and LinkedIn, consistently engaging with its growing community. In recent months, the community has expanded from 5,000 to over 15,000 members, with a goal to surpass 30,000 in the next three months. This growth is driven by a blend of content creation, gamification tactics, and strategic partnerships. Trakx uses engaging methods like contests, giveaways, and airdrops to build excitement, while regularly producing educational content to inform its audience about the platform and the crypto landscape. These articles are shared through the Trakx blog and external guest posting to bolster SEO efforts. Community development remains a core focus, with programs such as Growth Quests (via Zealy and Galxe) incentivizing members to actively participate in Trakx's expansion. Events like Ask Me Anything (AMA) sessions and Twitter Spaces provide direct interaction opportunities between the community and the team, further solidifying engagement and loyalty. To boost brand visibility and credibility, Trakx runs strategic PR and Key Opinion Leader (KOL) campaigns, working with agencies like Markchain and KOLhq to collaborate with top influencers in the crypto space. Press releases are regularly distributed to highlight key milestones, and direct messaging campaigns on platforms such as X and LinkedIn support cold marketing outreach efforts.

Team

Investors & Partnerships

Disclaimer

Before you consider participating in any investment opportunities on Finceptor, please take a moment to read and understand the following important information. Investing in cryptocurrencies, Web3 projects, and participating in token sales involve inherent risks you should be aware of.

Risk of Loss: Investing in cryptocurrencies and Web3 projects carries a significant risk of financial loss. Prices of tokens and cryptocurrencies can be extremely volatile and unpredictable. You could lose all or a substantial portion of your investment.

Research: You are responsible for conducting thorough research before participating in any investment opportunity. This includes understanding the project's purpose, technology, team, and market potential. Do not invest solely based on hype or promises.

Regulatory Considerations: Cryptocurrencies and Web3 projects are subject to various regulatory frameworks in different jurisdictions. Regulatory changes could impact the legality and functioning of projects. Ensure you understand the legal implications in your country or region.

Scams and Fraud: The cryptocurrency space has been associated with scams, fraudulent schemes, and phishing attacks. Be cautious of unsolicited offers, and always verify the authenticity of the information and individuals involved in a project.

Unpredictable Technology: Web3 projects use new and advanced tech that might not be fully checked. This could lead to problems and money loss.

Liquidity Risks: Tokens acquired through pre-sales or investments may not have an active secondary market initially, which could limit your ability to buy, sell, or trade them.

Financial Advice: The information provided on our platform, including whitepapers, project details, and investment recommendations, should not be considered financial advice. You should consult with a qualified financial advisor before making any investment decisions.

You acknowledge and accept these risks by accessing and using Finceptor's investment platform. You agree to conduct due diligence and make investment decisions based on your own judgment. Finceptor does not assume any responsibility for your investment choices or the outcomes thereof.

Please remember that investing in cryptocurrencies and Web3 projects can be speculative and involves high risk. Only invest what you can afford to lose.

This disclaimer is designed to inform potential investors about the risks and considerations associated with participating in the Finceptor investment platform. However, it is advised to consult legal experts to ensure the disclaimer is appropriate for your specific circumstances and legal requirements.

Purchasing, holding, and transacting in any way with tokens shall not warrant, commit nor guarantee any revenue, profit, or value appreciation. Purchasing tokens shall not be construed as an investment. Token merely offers utilities and features within the project’s ecosystem and platforms. Finceptor reserves its right to amend and modify the utilities and features offered by the project.

Crypto and crypto assets transactions, including tokens, are very risky regarding potential losses, merchantability, technical failures, and legal and tax requirements. Indeed, the price of crypto assets can even become zero or be excessively volatile. By purchasing and holding or transacting in any way with the token, you agree and acknowledge that you undertake such risks on your own and shall consult your legal and tax consultants for compliance purposes.

We do not provide investment or financial advice, and all projects reviewed are done objectively in accordance with established reporting and information dissemination best practices. Before investing in any Web3-related project, you should conduct your research. As a result, Finceptor is not liable for any losses incurred due to a consumer’s investment decision.